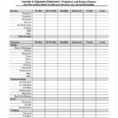

Financial analysis spreadsheet is the process of compiling data and compiling reports on an amount of financial information in an easy to read format. Financial analysis spreadsheet helps an accountant to prepare reports to the client’s representative as required by the law. However, when financial analysis spreadsheet is used for…

Tag: financial statement analysis spreadsheet examples

Financial Spreadsheet Example

Financial spreadsheet example will be useful to you if you’re already familiar with Excel. But if you’re a beginner, perhaps you are not interested in spending money on software that might be obsolete in a couple of months. Financial spreadsheets are not difficult to create, even for someone who’s never…