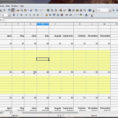

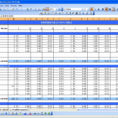

Financial spreadsheet example will be useful to you if you’re already familiar with Excel. But if you’re a beginner, perhaps you are not interested in spending money on software that might be obsolete in a couple of months. Financial spreadsheets are not difficult to create, even for someone who’s never…

Tag: Financial Spreadsheet Example

Financial Spreadsheet

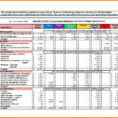

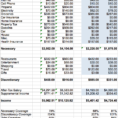

If you are a financial planner, an entrepreneur or an investor, then you know how important financial spreadsheet services are to help you manage your business. However, did you know that financial spreadsheet services can do so much more? Do you know that large and big companies usually use these…

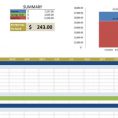

Financial Spreadsheet Template

Financial Spreadsheet Template: No Longer a Mystery A spreadsheet can improve your accuracy. It should have plenty of room to add expenses as necessary. It’s possible to even work on the on-line spreadsheet, which is also an additional feature also. You can begin by developing a spreadsheet. First thing you…