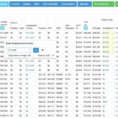

Financial spreadsheet example will be useful to you if you’re already familiar with Excel. But if you’re a beginner, perhaps you are not interested in spending money on software that might be obsolete in a couple of months. Financial spreadsheets are not difficult to create, even for someone who’s never…

Tag: financial plan spreadsheet example

Financial Planning Spreadsheet Template

While preparing for an upcoming meeting, the financial planning spreadsheet template is among the best tools that can help prepare for the gathering. There are various documents that must be prepared in advance to ensure smooth proceedings. The first document, obviously, is the current balance sheet. The current balance sheet…