Retirement income planning sheets provide an important part of your retirement income planning toolbox. They are useful tools to keep track of your financial goals. This guide explains how to use them effectively. The purpose of a retirement income planning sheet is to help you put a plan together that…

Tag: fidelity retirement income planning worksheet

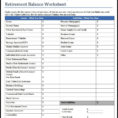

Fidelity Retirement Income Planner Worksheet

Fidelity Retirement Income Planner Worksheet in an understanding moderate can be utilized to check students qualities and understanding by addressing questions. Because in the Scholar Worksheet about 90% of the articles of the entire guide are issues, equally multiple decision and answer questions which are not available. While the others…