Expense Tracking Worksheet in an understanding moderate may be used to try students capabilities and knowledge by answering questions. Because in the Scholar Worksheet about 90% of the articles of the entire book are questions, both numerous choice and answer issues that aren’t available. While the rest includes a brief…

Tag: Expense Tracking Spreadsheet For Tax Purposes

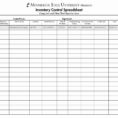

Expense Tracking Spreadsheet Template

Expense Tracking Spreadsheet For Tax Purposes

When looking for an expense tracking spreadsheet for tax purposes, you will need to make sure that you can easily transfer the information to your tax returns. This can be a very time consuming process, and it can be difficult to keep up with all of the relevant data. The…

Spending Tracker Spreadsheet

The Tried and True Method for Spending Tracker Spreadsheet in Step by Step Detail When you’re ready to combine your budget by means of your money tracking, take a look at the Money Management Template. If you’re searching for the simplest and best FREE approach to maintain a budget and…

Expense Tracking Spreadsheet

All You Need to Know About The Importance of Using a Business Expense Tracking Spreadsheet Expense tracking spreadsheet is considered as the best option for planning a business. It makes the task of tracking expenses easy and hassle free. As this worksheet contains all the details of each and every…