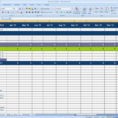

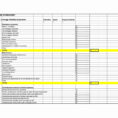

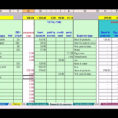

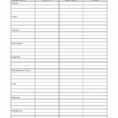

Do you need to make a self-employed expenses spreadsheet? Self-employed persons usually use these types of expenses for tax purposes. By making this type of expenses spreadsheet, you can easily calculate your tax liability. The expenses are actually quite simple to do and can be done without a lot of…

Tag: excel spreadsheet for self employed expenses

Expenses For Self Employed Spreadsheet

What You Don’t Know About Expenses for Self Employed Spreadsheet The Fight Against Expenses for Self Employed Spreadsheet If you’re putting out more for expenses than your real income will permit you to do, then look to see where you are able to make cuts. Naturally, ahead of tracking your…