Profit and expense sheets are often a product of accounting. It is an overview of how an organization uses their assets, income, and expenses. The Profit and Expense sheet is used by a wide variety of organizations. From the business owner to the accounting firm to the CFO to the…

Tag: Excel Income And Expense Template

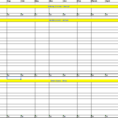

How To Track Expenses In Excel

The Hidden Secret of How To Track Expenses In Excel There are a number of different ways to keep an eye on your expenses and you ought to pick one which works for you. Contemplating the present economic environment, an individual may desire to better keep tabs on personal expenses….

Spreadsheets For Small Business

The Downside Risk of Spreadsheets for Small Business That No One Is Talking About As you get your company going, you might want to think about utilizing a more thorough small business budget and other financial statements. Even if your cleaning business is as easy as one person, a bucket…