Bookkeeping Spreadsheet Template Free 3 at a Glance What You Need to Know About Bookkeeping Spreadsheet Template Free 3 There likely to be a lot of work involvedfor example not only do you will want to complete the spreadsheets, but you should do all of the math yourself. Kinds of…

Tag: Example Of Bookkeeping Spreadsheet

Spreadsheet For Small Business Bookkeeping

All About Spreadsheet for Small Business Bookkeeping So long as you keep current with your payments that is. Reconcile transactions each and every day or at least every week so that you don’t get rid of an eye on the information. Take time to find out how you wish to…

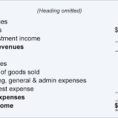

Self Employment Bookkeeping Sample Sheets

The Battle Over Self Employment Bookkeeping Sample Sheets and How to Win It Bookkeeping is the procedure of keeping full and up-to-date small business records. From time to time, it is a ton simpler to begin your QuickBooks bookkeeping over from the beginning and do it the proper way. Bookkeeping…