The Quintessential Handbook to Estate Executor Spreadsheet Being an executor isn’t an easy job, and it may feel downright overwhelming. He or she also works in conjunction with an attorney to make sure that all of the final arrangements with the family are taken care of. When you are deciding…

Tag: estate executor spreadsheet

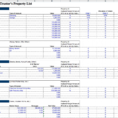

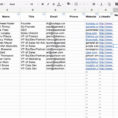

Estate Administration Spreadsheet

The Meaning of Estate Administration Spreadsheet Fees might apply for services. The probate referee fee could possibly be statutory or set by custom in the region. Tax preparer fees may run anywhere from two or three hundred dollars to a couple thousand dollars in the event the state is large…