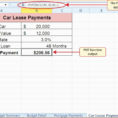

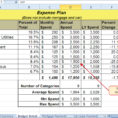

The most important thing that you can do when renting equipment for a business is to use an excel spreadsheet for rent calculations. Calculating the monthly lease payments and accruing rental costs on paper is very complicated, time consuming and inaccurate, especially if there are other factors such as tax…

Tag: equipment lease calculator excel spreadsheet

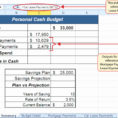

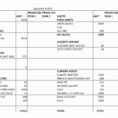

Lease Calculator Spreadsheet

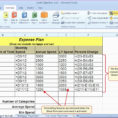

Lease calculator spreadsheet can be a great tool in estimating the duration of your lease. It is also used by many business owners to determine their monthly expenses, and some even use it to pay off some of their debt. You can get a lot of information on your lease…