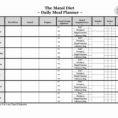

Keeping a Track of Time and Expenses In order to keep a track of time and expenses, you may need to have an employee schedule spreadsheet. The purpose of this time and expense spreadsheet is to help you stay organized. Your staff and yourself may have different duties, such as…

Tag: Employee Hours Spreadsheet

Employee Hours Spreadsheet

A History of Employee Hours Spreadsheet Refuted You’ll have to sell yourself each time that you put in a bid. Working full time usually suggests you’ll obtain a guaranteed paycheck. You also won’t need to devote any time prospecting for new work unless you’re searching for a job with a…

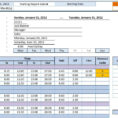

Schedule Spreadsheet Template Excel

New Questions About Schedule Spreadsheet Template Excel Answered and Why You Must Read Every Word of This Report Projections Excel’s capacity to extrapolate on data and project likely future numbers can let you plan for special events or simply regular seasonal alterations. The advantage of online Gantt charts is they…