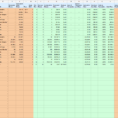

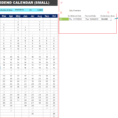

One Easy Trick for Dividend Aristocrats Spreadsheet Revealed To start with, you’ve got to ready the spreadsheet in Google Apps. It’s possible that you name your spreadsheet whatever you would like. You may use the Dividend Aristocrats spreadsheet to swiftly find excellent dividend investment ideas. What Is So Fascinating About…

Tag: dividend aristocrats excel spreadsheet

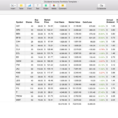

Dividend Excel Spreadsheet

The Bizarre Secret of Dividend Excel Spreadsheet Nowadays you own a template, both packed and clean, it’s going to provide you with a sense regarding how you’re capable of going about making your own. It’s possible for you to choose an installed template to make a new workbook. It’s possible…