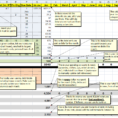

Excel, among the Office applications, is still the 800-pound gorilla in spreadsheets. It is possible to name your spreadsheet everything you want. As soon as you’ve printed your spreadsheet, make a new chart or edit existing one and visit the second step, which gives you the ability to upload your…

Tag: debt snowball spreadsheet template

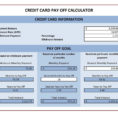

Debt Snowball Spreadsheet

Debt snowball spreadsheet is a program you can use to create an Excel file that will give you a report of your unsecured credit card debt. This free program can tell you the true number of credit cards and then the amount owed. You will be able to see what…