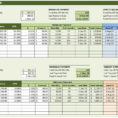

The War Against Debt Repayment Spreadsheet Your debt can vary from your college student loans, your charge card debt, mortgage, and any other debt which you want to pay off the moment you are able to. Whenever your very first debt is wholly paid, the rest of your snowball is…

Tag: debt reduction spreadsheet snowball

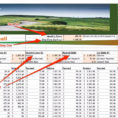

Debt Reduction Spreadsheet

Debt Reduction Spreadsheet – Student Loans, College Financial Aid and Debt Reduction Strategies There are two types of consumers that need a debt reduction spreadsheet and they are both college students. Let’s look at these two groups of consumers and what they need to know to be successful with their…