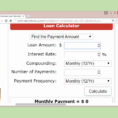

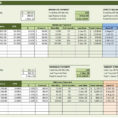

Debt Reduction Spreadsheet – Student Loans, College Financial Aid and Debt Reduction Strategies There are two types of consumers that need a debt reduction spreadsheet and they are both college students. Let’s look at these two groups of consumers and what they need to know to be successful with their…

Tag: debt reduction spreadsheet free

Debt Reduction Spreadsheet Free

Debt Reduction Spreadsheet Free – The Best Way to Eliminate Your Debts Once you find a program that will help you pay off your debt, the next thing to do is to go on the internet and look for a Debt Reduction Spreadsheet Free! This would help you be able…