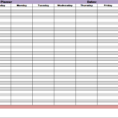

Debt Payoff Worksheet Pdf in an understanding moderate may be used to test pupils talents and understanding by answering questions. Since in the Scholar Worksheet about 90% of the articles of the whole guide are questions, both numerous decision and answer issues that are not available. While the rest includes…

Tag: Debt Payoff Worksheet Pdf

Debt Management Spreadsheet

Using a Debt Management Spreadsheet to Manage Your Finances Debt management is a service that is intended to manage one’s finances and is meant to prevent bankruptcy. A management plan will help the debtor to get back on track with finances and to gain financial control. If this sounds like…