Using a credit card spreadsheet to monitor your spending and balance is a great idea. There are so many benefits that come with using such a program. This article will show you the many benefits of using a credit card spreadsheet to track your spending and manage your money more…

Tag: credit card tracking spreadsheet template

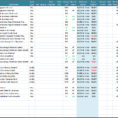

Credit Card Tracking Spreadsheet Template

Should you commence using Google docs a good deal, you might want to organize your files into various folders. Google provides a nifty trick in case you don’t know the origin language. Google specifies that the images are offered for personal or business use just in Google Drive and has…

Credit Card Tracking Spreadsheet

A credit card tracking spreadsheet is simply a file that you put into Excel and other spreadsheet programs to track your transactions. Using this form of program you can monitor your spending, keep track of any offers you may have received, know exactly what you’re owed, and even keep track…