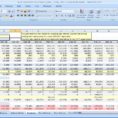

Using a credit card spreadsheet to monitor your spending and balance is a great idea. There are so many benefits that come with using such a program. This article will show you the many benefits of using a credit card spreadsheet to track your spending and manage your money more…

Tag: Credit Card Spreadsheet Template

Personal Finance Spreadsheet Template

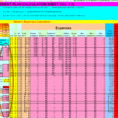

Financial Planning Excel Spreadsheet

If you are considering going to college, it is a good idea to first find out if you need financial planning Excel spreadsheet software. This is not something that should be rushed into but needs to be considered with some thought and research. For those who have recently graduated or…