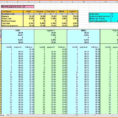

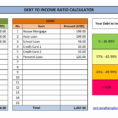

If you own a credit card or are planning to acquire one, it is always important to determine if the device you are using is safe and to find a good credit card repayment calculator spreadsheet. The calculator is useful when you do not know how much you can afford…

Tag: credit card payoff calculator spreadsheet

Credit Card Payoff Spreadsheet

In case you’re in need of a spreadsheet to help you look up your credit card payoff balances, you might want to look into the credit card payoff spreadsheet. If you’re not familiar with these types of spreadsheets, they basically are a spreadsheet that lists down your balances in a…