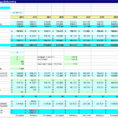

When you are buying or selling a business, or even when you are a landlord, there are a lot of tools that you can use to help you decide if you want to rent or buy the property. A commercial real estate lease analysis spreadsheet will allow you to get…

Tag: commercial real estate lease analysis spreadsheet

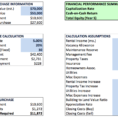

Commercial Real Estate Analysis Spreadsheet

A Commercial Real Estate Analysis spreadsheet will help you evaluate the market for a property, looking at things like average annual income per household, and where it is likely to fall. In terms of yearly income per household, the report will compare this to the average of the region and…

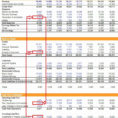

Commercial Real Estate Spreadsheet

A Fool’s Handbook to Commercial Real Estate Spreadsheet Revealed Real estate has undergone a good deal of change in late decades, therefore it’s important to leverage new tools to discover the investment that suits your long-term financial strategy best. Real Estate is among the most gainful investment alternatives. As you…

Commercial Lease Analysis Spreadsheet

A commercial lease analysis spreadsheet can be the key to successful leasing your business. In this type of system, you enter all the data you have regarding your business and have it analyzed for any flaws that may arise in the lease contract. These errors may be either administrative or…