If you are a commercial borrower, or you are thinking about starting your own business, then you will need to look into commercial loan comparison spreadsheet. This is an interactive spreadsheet that will allow you to enter the details of each company that you would like to know more about….

Tag: commercial loan comparison spreadsheet

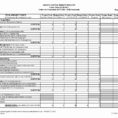

Loan Comparison Spreadsheet

A loan comparison spreadsheet is an electronic spreadsheet that can be used to compare the different features of loans from different lenders. This is a great way to make sure you are getting the best rate on your new car loan or home mortgage loan and to avoid paying more…