If you want to use a cash flow spreadsheet to help guide your business decisions, then you’ve probably already made up your mind to learn how to do it. This way, you’ll be able to stay on top of your financial situations and find solutions to difficult business problems. In…

Tag: Cash Flow Spreadsheet Template Free

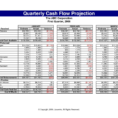

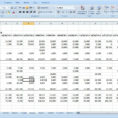

Cash Flow Spreadsheet Template Free

A cash flow spreadsheet template for a startup is a very powerful tool to help you get your business off the ground. When you’re thinking about getting your own business started, there are a lot of questions you need to ask yourself, such as: Do I want a little income,…

Cash Flow Spreadsheet Template

Cash Flow Spreadsheet Template – What Is It? Therefore, a positive cash flow is completely integral to the development of a little company. Free cash flow is also referred to as FCF. What’s more, when investing for your organization, you are essentially using your upcoming cash flow to fund your…