If you want to use a cash flow spreadsheet to help guide your business decisions, then you’ve probably already made up your mind to learn how to do it. This way, you’ll be able to stay on top of your financial situations and find solutions to difficult business problems. In…

Tag: cash flow spreadsheet budget challenge

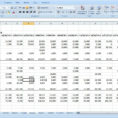

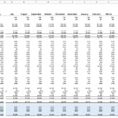

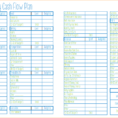

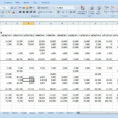

Cash Flow Budget Spreadsheet

The idea of having a cash flow budget spreadsheet is to be able to create a financial plan based on the major accounts. The cells are used to label the major payments, the expenses and the income. By using a spreadsheet, you can make a budget and use the entries…