A business valuation spreadsheet template is designed to get the most accurate information from the company’s financial statements. If you’re trying to find a template that will get the results you want, it helps to understand the formula used to arrive at the results. Business valuation, more formally known as…

Tag: business valuation spreadsheet template

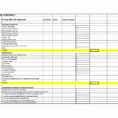

Business Valuation Spreadsheet

Using a Business Valuation Spreadsheet to Value Your Business A business valuation spreadsheet is one of the best ways to determine if your product or service is worth its cost. Without a business valuation spreadsheet, you can’t get a good feel for how much your business is worth. You don’t…