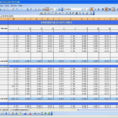

If you are in the home-based business industry, you will need a good income expenses spreadsheet. You must know where your money is going, or else you won’t make any money. This is why you should look for the best income expenses and profit accountants.

Having a good profit spreadsheet is important to having success as a home business owner. It is also useful to track expenses that you have incurred. If you are like most others who are trying to make a home business success, this would be very beneficial to you.

You will see it is very easy to make a business work. Start with an income expense spreadsheet. It is important to keep track of the cost of living expenses that you have incurred. If you do not, you will be spending more than you are making.

Using Income Expenses Spreadsheet

There are several ways to create an income expense sheet. If you have not discovered one that works for you, here are a few suggestions that can help you.

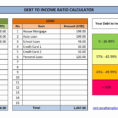

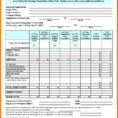

For beginners, you can add multiple line items for your weekly expenses. This is the easiest way to do it because you only have to enter the number of your week.

If you want to go another level, you can separate your weekly expenses into a single day, monthly, or yearly. If you want to be more detailed, it is also possible to add column headings.

If you want to make a higher-level income expense sheet, you may want to add columns that represent your categories. Some of these categories may include basic needs, household expenses, tools, supplies, entertainment, etc.

Then, you may want to add an additional column to reflect additional things you purchase that you did not budget for. This can help you catch items that you have forgotten to budget for, thus saving you money.

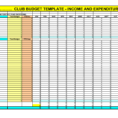

Using a different template to make your income expense sheet is also possible. There are actually some websites that offer templates for home business owners. If you find one that you like, you can use it to make your income expense sheet.

If you want to, you can even make your income expenses on a weekly basis. If you plan to, you can make a graph showing the path of your expenses as they change over time.

An income expenses spreadsheet is a very important tool that is very helpful for any entrepreneur. This is why it is important to find a reputable business or CPA that will supply you with a good program.

You will also want to get some financial reports to check your accuracy. Many home business programs will also give you access to a portfolio of income expense accounts to check out to make sure you are getting accurate information. PLEASE READ : income spreadsheet excel