Financial Planning Solution Free – Make a Plan to Help Yourself From Pockets Financial planning has always been one of the key skills to have. With this skill, you can plan your money in order to achieve your dream home, your children’s education and health care, and even ensure that…

Tag: Business Financial Plan Template

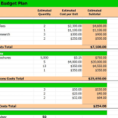

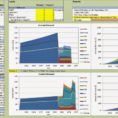

Financial Planning Excel Sheet

The Pitfall of Financial Planning Excel Sheet The Financial Planning Excel Sheet Pitfall When you’ve established a budget, you are going to want to make decent use of all that spare money which you’ve been in a position to create. Given the simple fact a family budget isn’t exactly an…