Tag: Business Expenses Spreadsheet Template Uk

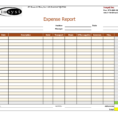

Business Expenses Spreadsheet

How to Use the Business Expenses Spreadsheet Managing business expenses is important, but not as important as how to use a Business Expenses Spreadsheet. That way you will know exactly where your money is going. That way you will be able to better organize your finances and the big picture….

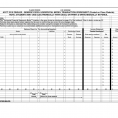

Business Expenses Spreadsheet Template Uk

Some documents take a lengthy time to download but that’s dependent on your link. Do more, jointly with Google Docs, everyone is able to work together in the exact same document in the identical time. A rising number of people utilize PDF documents to discuss their ideas over the net….

Business Cost Spreadsheet

Many small business owners spend a great deal of time on their business cost spreadsheet, often on a daily basis. While it is an extremely important tool for any small business owner, it’s also often overlooked. The fact is that a business cost spreadsheet is crucial to any small business….

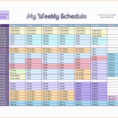

Business Finance Spreadsheet

When you’re starting a new business, you need a business finance spreadsheet to keep track of all the finances you are expected to have. The spreadsheet can be used for many purposes. For example, you might have to set up a bank account with the bank you’ll be working with….

Excel Expenses Template UK

An Excel Expenses Template UK that fits your personal circumstances and the type of company you run is the best option to consider when you need to keep track of what you spend on paper. It can save you time and money in the long run and will help you…