How to Use the Business Expenses Spreadsheet Managing business expenses is important, but not as important as how to use a Business Expenses Spreadsheet. That way you will know exactly where your money is going. That way you will be able to better organize your finances and the big picture….

Tag: business expenses spreadsheet

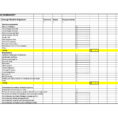

Business Cost Spreadsheet

Many small business owners spend a great deal of time on their business cost spreadsheet, often on a daily basis. While it is an extremely important tool for any small business owner, it’s also often overlooked. The fact is that a business cost spreadsheet is crucial to any small business….