Tag: Bookkeeping Spreadsheet Templates

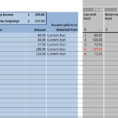

Bookkeeping Excel Spreadsheet

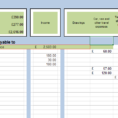

Spreadsheet Bookkeeping

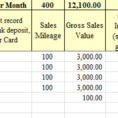

Sole Trader Accounts Spreadsheet

Want to Know More About Sole Trader Accounts Spreadsheet? Sole Trader Accounts Spreadsheet: No Longer a Mystery It’s possible to only open savings accounts created for businesses. If you require proper accounts that it is possible to submit to banks and financiers for finance, then we will need to modify…

Bookkeeping Excel Spreadsheet

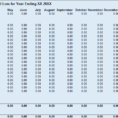

Bookkeeping Spreadsheet Template

Spreadsheet Bookkeeping

What Spreadsheet Bookkeeping Is – and What it Is Not If you’re making an enormous income from Avon, then you will need to file and pay an estimate income tax each quarter so that you are not going to have a bunch of taxes to pay at the close of…