In order to generate a bond ladder spreadsheet, you need to know a little bit about your bonds. Make sure that the bonds you want to look at are backed by a government or some kind of legal entity. Don’t forget that government bonds are always backed by the government….

Tag: bond ladder excel spreadsheet

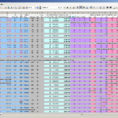

Bond Ladder Excel Spreadsheet

Bond Ladder Excel Spreadsheet Secrets That No One Else Knows About If you’d like to use the spreadsheet, then you will have to click enable content. Otherwise, you will have to debug the spreadsheet. The spreadsheet contains several worksheets. It’s very easy to make a blank budget spreadsheet, because of…