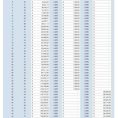

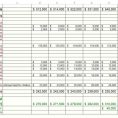

With the increasing popularity of all the free retirement calculators, a lot of people are venturing into using the best retirement calculator spreadsheet. The main benefit is that you get to use it even without having to spend money on it. All you need to do is to get your…

Tag: Best Retirement Calculator Spreadsheet

Retirement Calculator Spreadsheet

All About Retirement Calculator Spreadsheet Spreadsheets are somewhat more versatile than word processors when it comes to their capacity to manipulate massive quantities of rows and columns of information. The spreadsheet is going to do the rest for you. To put it differently, it’s a spreadsheet that can help you…