In simple terms, a basic accounting spreadsheet is a piece of computer software used to create financial records. Its origins date back to the mid-1970s, when financial managers started to use one to record their operations and the resulting increase in profits. It soon became standard practice for companies to…

Tag: Basic Accounting Spreadsheet For Small Business

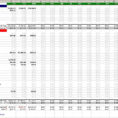

Simple Business Accounting Spreadsheet

Simple Income Statement Template

Simple Business Accounting Spreadsheet

Simple Business Accounting Spreadsheet Tips & Guide Imagine you own a business and you’ve got a building for it. Knowing to what degree your business should supply you personally is a highly effective figure. If a business has supplied a good or service they are eligible to get whole recompense…

Simple Business Accounting Spreadsheet

Basic Accounting Spreadsheet For Small Business

How to Make a Basic Accounting Spreadsheet For Small Business A basic accounting spreadsheet for small business might include both a business and a personal section. The business section would include the financial information such as business assets, property, workers, cash flow, revenues, profits, and expenses. A personal section would…