Top Choices of Spreadsheet to Track Loan Payments

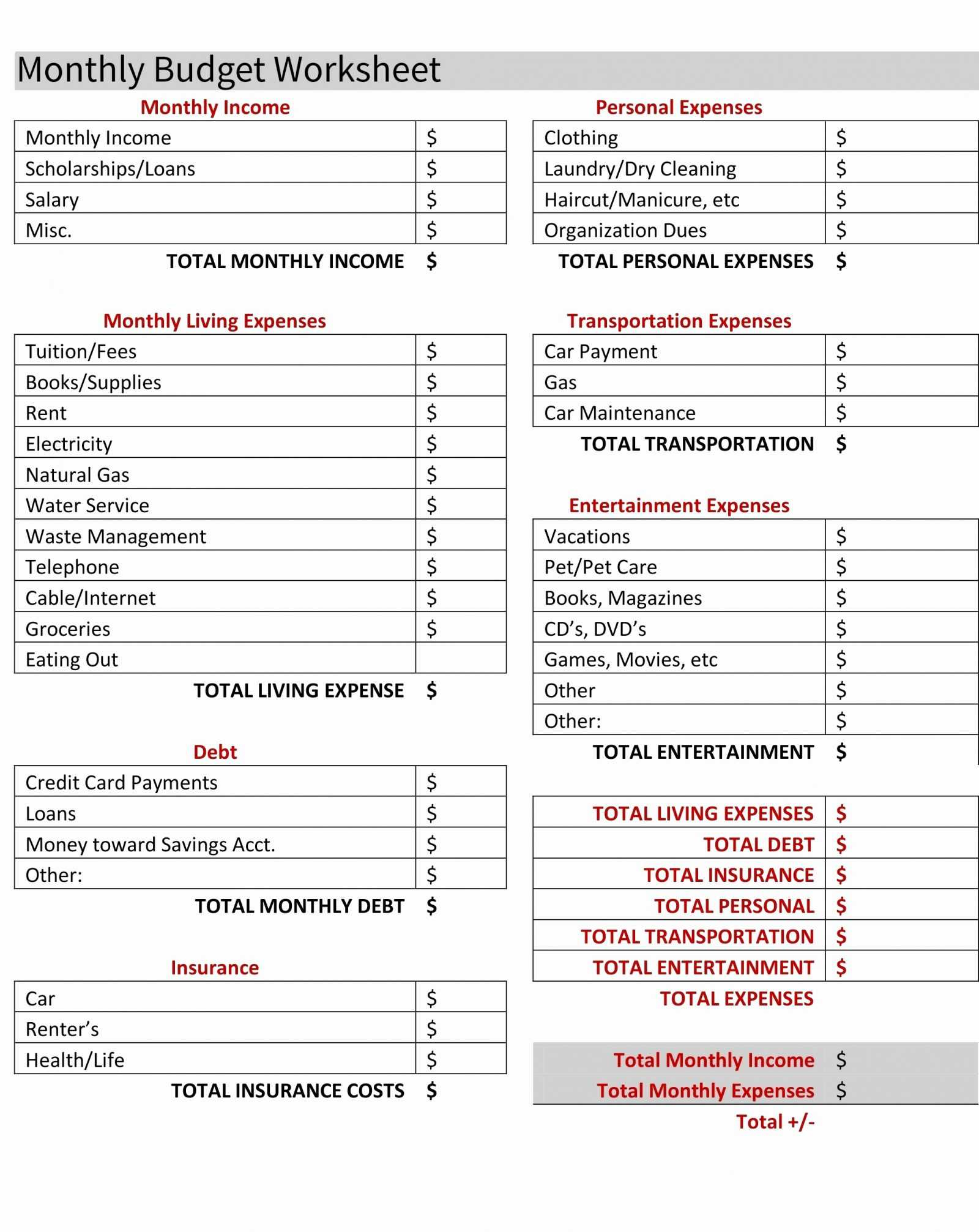

You have to know the quantity of the loan, the interest rate of the loan, the quantity of payments, the quantity of the payments and volume of the balloon payment. You will likewise be able to see how you are going to have the ability to pay your loan as time passes by or if you’re going to fall short of payments later on. Crucially, it can juggle several loans simultaneously. The principal reasons you might think about selecting a balloon loan on a conventional loan, are because balloon loans have a tendency to be simpler to qualify for and they typically arrive with lower rates of interest.

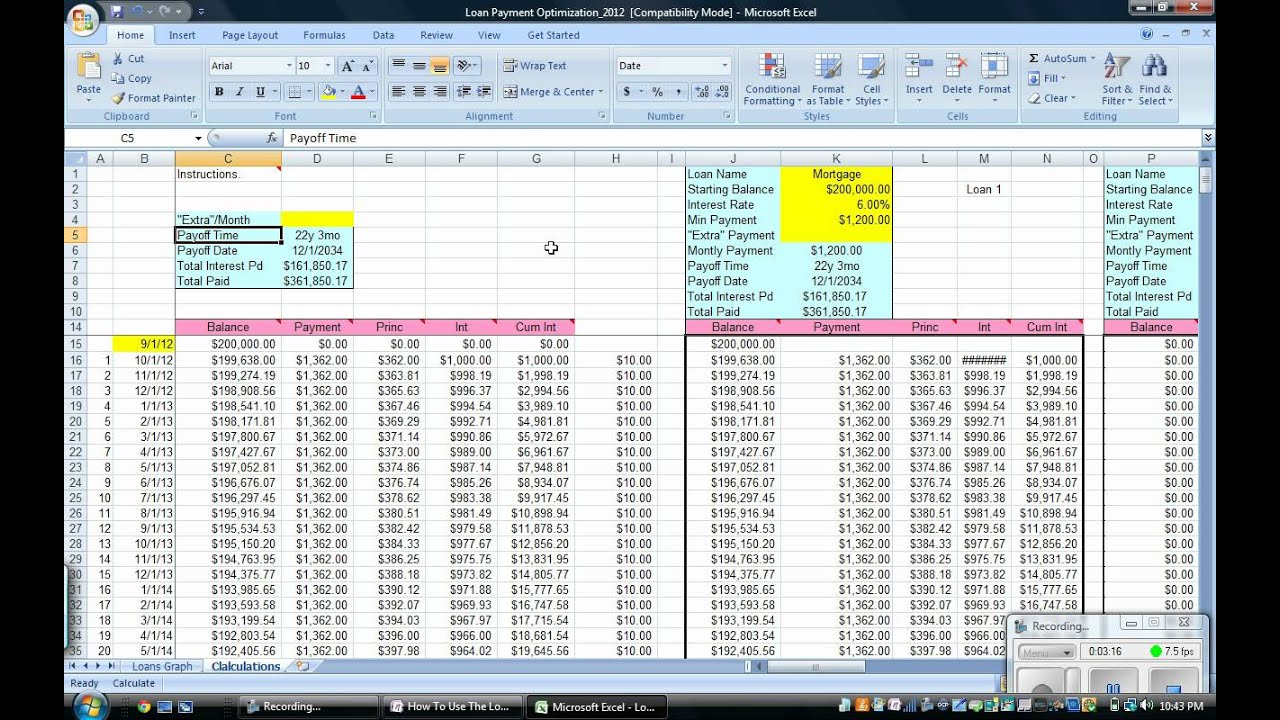

Luckily, it’s simple to track financing with a very simple spreadsheet template, so you will have the information that you want to manage payments and make decent business decisions. Therefore, you will observe that it’s not economically a good idea to payoff your loan in the very first half of your loan period. Be sure to find expert advice before registering for an interest only loan. For most people, the interest-only loan is a great alternative if you don’t intend to continue to keep your property for a lengthy time. For instance, interest-only mortgage loans are extremely risky in the event the market price of the property falls during the loan period and you would like to sell the property.

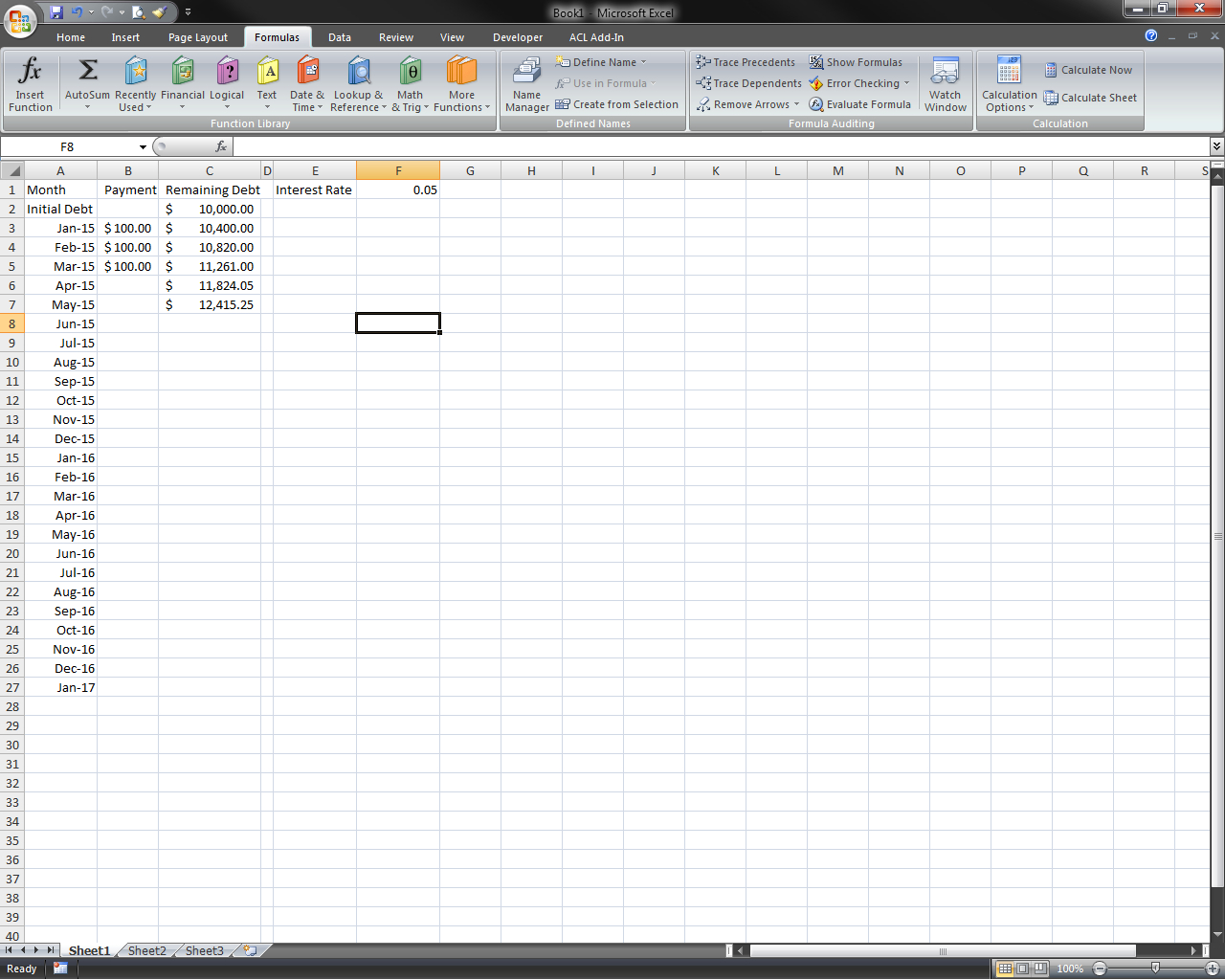

The details required are the loan sum, the rate of interest, the amount of years over which the loan is taken out, and the quantity of payments each year. In the end, there are the specifics of the loan. With spreadsheets, you are going to be able to find out what are the critical specifics about your loan plus, automatic calculations may also be made out of the aid of the spreadsheets.

Want to Know More About Spreadsheet to Track Loan Payments?

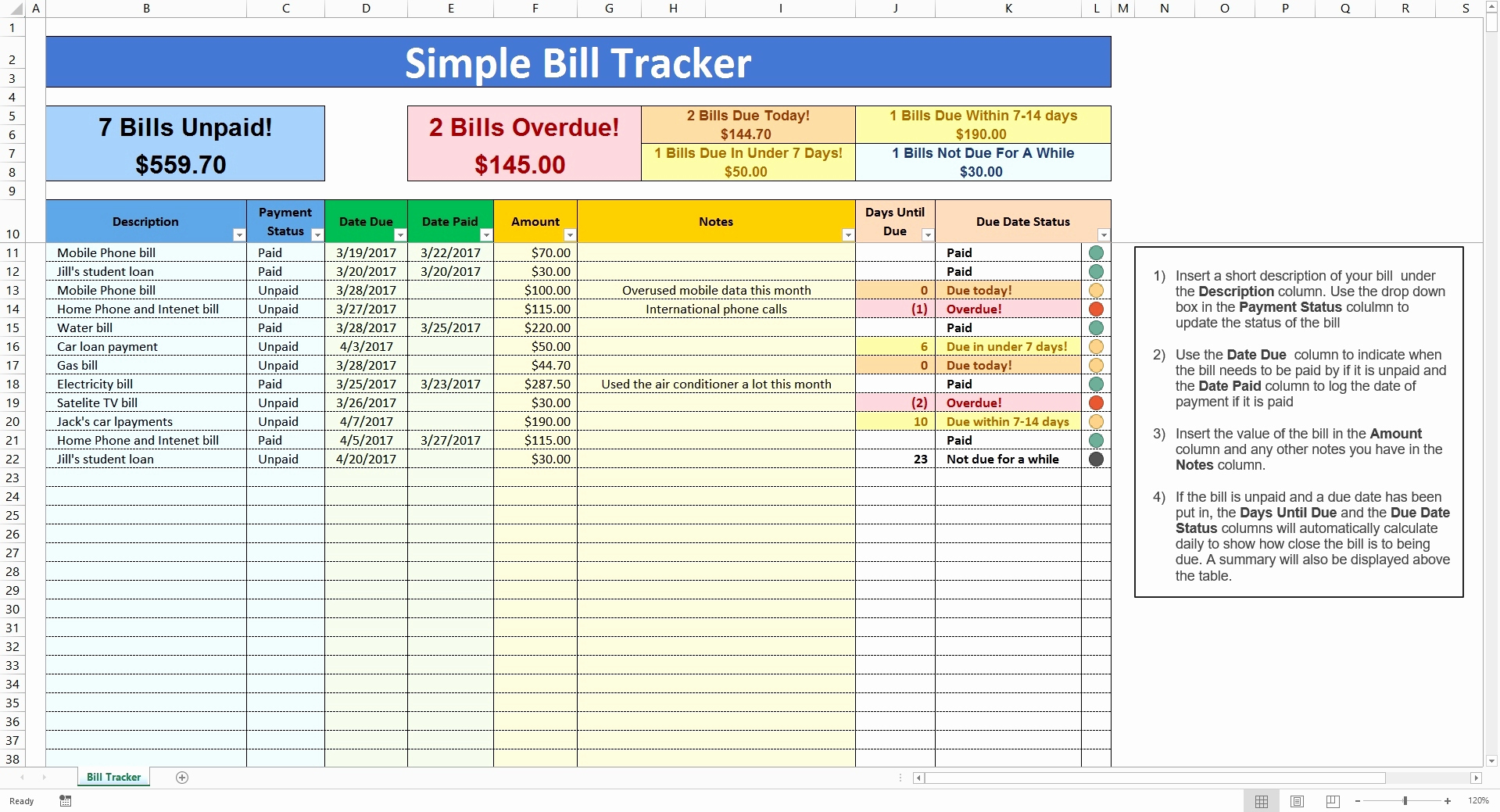

Sure, it might take long but taking it one payment at one time is essential to making sure everything will work out fine for you in the long run. The monthly quantity of payments that you’ll be making on a monthly basis will change based on the amount of payments you will make and if you’re going to be making additional loans while still paying the present loan which you have. Make at least the minimum payment in time, and update your spreadsheet every time you make a charge card payment.

The 5-Minute Rule for Spreadsheet to Track Loan Payments

Your debt can vary from your college student loans, your charge card debt, mortgage, and any other debt that you would like to pay off once you are able to. After speaking with your loan officer for the very first time, you will probably feel a whole lot better about your debt. Paying off debt can be very a challenge especially when you have tons of it. It refers to anything that you owe someone else. Our tips will likewise help you out should you acquire debts later on.

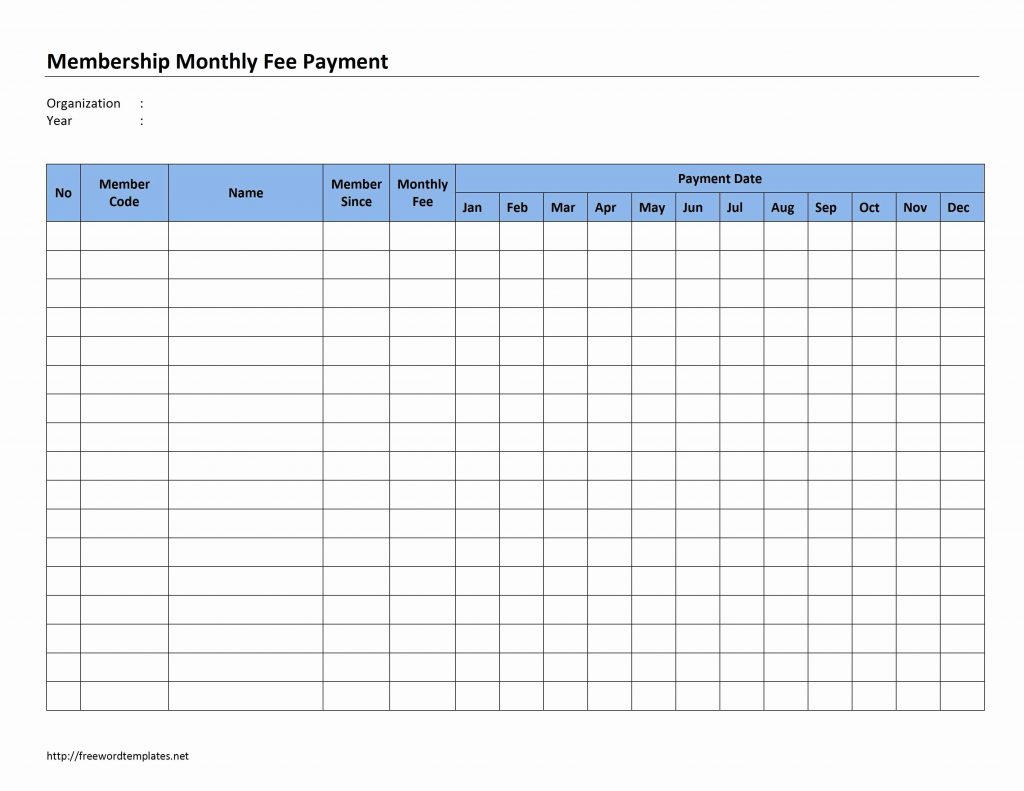

Fill in the correct sections with the payments you need to track. Every thriving payment you make ought to be viewed as a kind of encouragement to complete paying back your debt and reach your target on your set deadline. As an example, maybe you simply wish to make more payments in even numbered months. It’s possible to also record payments manually, and get payment reminders to prevent late fees. You’ll realize that your payments, from beginning to end, are listed that you review.

You are able to enter payments made by clients and permit the template calculate balance outstanding quantities. For instance, you might be in a position to see whether your payment will be consistent all throughout and in the event you are going to be able to lessen the quantity of interest you’re going to be paying. Now you are aware of how to compute your monthly payments on financing, and the way to use a data table in Excel to observe the way the monthly payment will change with diverse combinations of input values.

Spreadsheet to Track Loan Payments – What Is It?

There likely to be a good deal of work involvedfor example not only do you have to finish the spreadsheets, but you have to do the math all yourself. At this point you have a spreadsheet that will calculate your payments and the whole amount you will cover your loan. Spreadsheets might also be published and distributed as a means to supply records or documentation. Since general spreadsheets basically execute the calculations for you, you’re able to easily observe the total amount of payment that you have to pay on a month-to-month basis. The totally free spreadsheet is readily readily available for download here. Making your initial standard spreadsheet isn’t an elaborate undertaking whatsoever.

OKR spreadsheets are an excellent beginning but quite limited to a software tool that’s dedicated. If you would rather make your own spreadsheet to keep track of your equipment loan or line of credit, it’s simple to accomplish. With the aid of your spreadsheet applications, you will certainly be in a position to produce your own loan spreadsheet very quickly.