If you’re going to buy a home in the UK, there are many different types of spreadsheets forms that you will need to have. These can be very useful and important. You need to make sure that you’re comfortable with the fact that some are legal documents while others aren’t.

There are many reasons why you may want to use one of these documents. Perhaps your family doesn’t have a clue about how to take care of your home. Then you may want to get help from a lender for example.

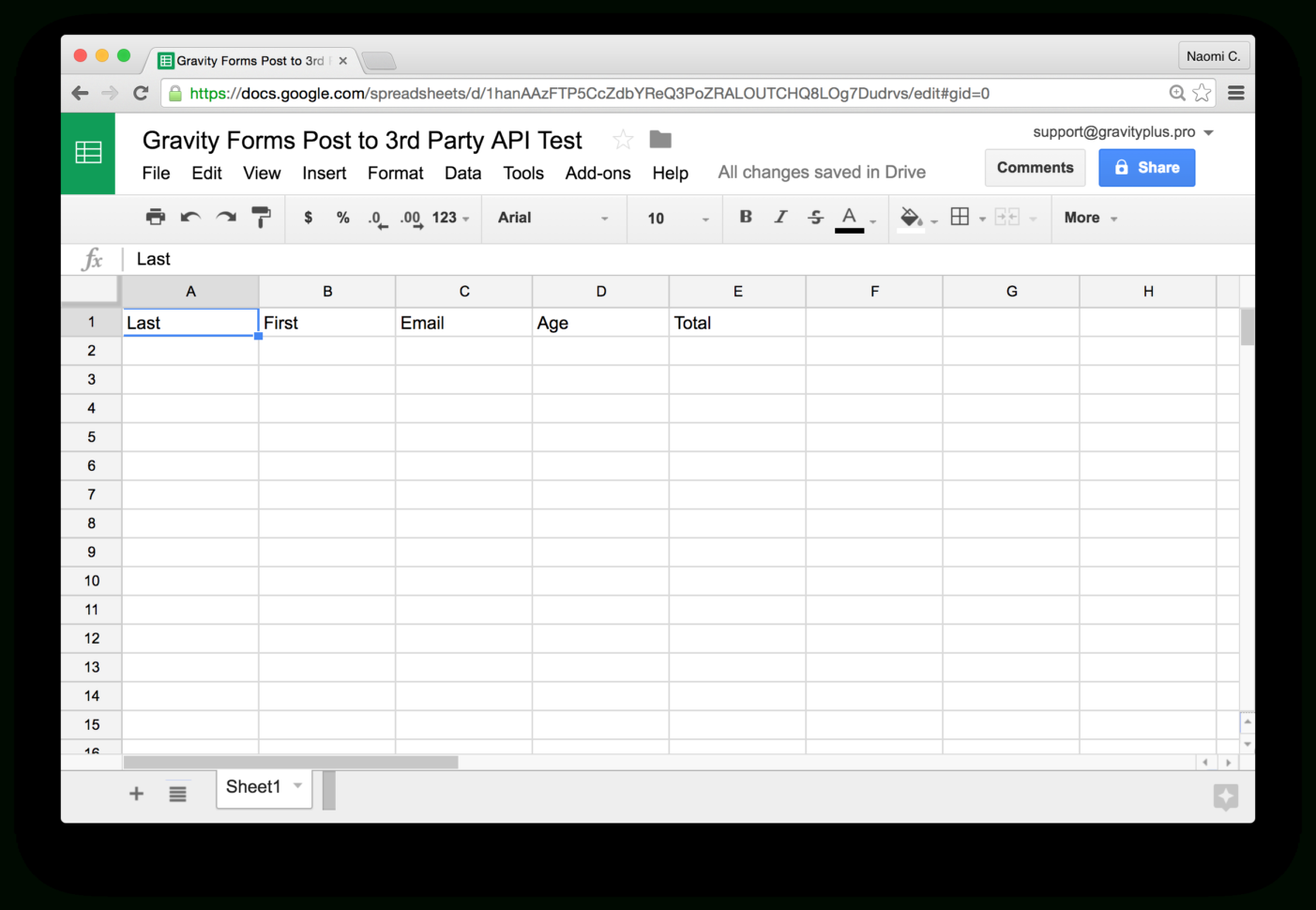

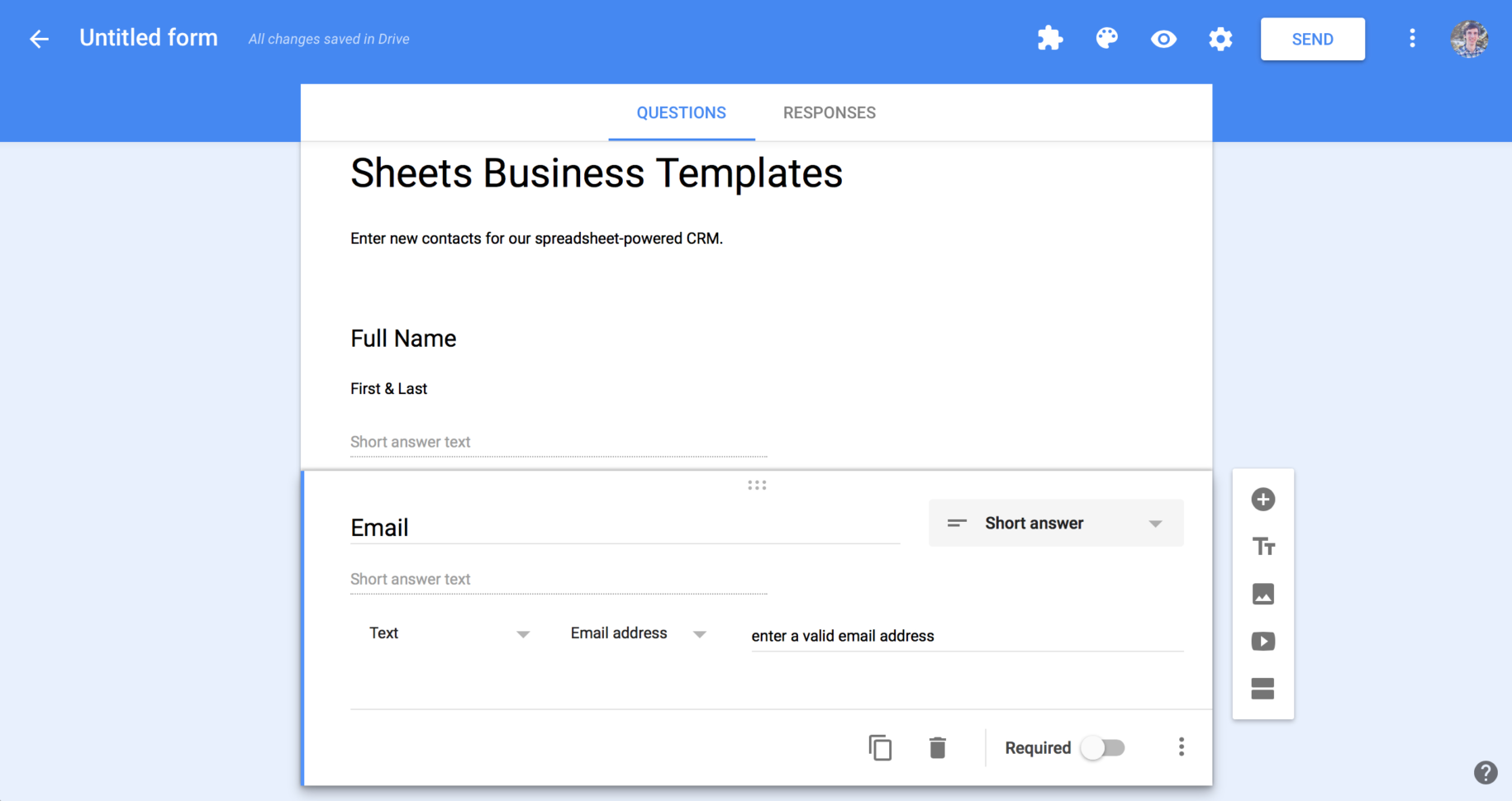

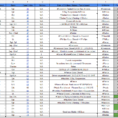

When a mortgage broker is working with you to help you find a loan, you’ll be asked to fill out a form called a Mortgage Application Form. This will basically tell them the info about your credit, income, and whether or not you’ve already found another property to live in.

Why You Need Spreadsheet Forms For Your Mortgage Loan

By filling this out for your own benefit, you can go through it at your leisure and really learn what kind of help you need. If you want to find out more about this, you can go online and find that kind of information. It’s never been easier to find this kind of information.

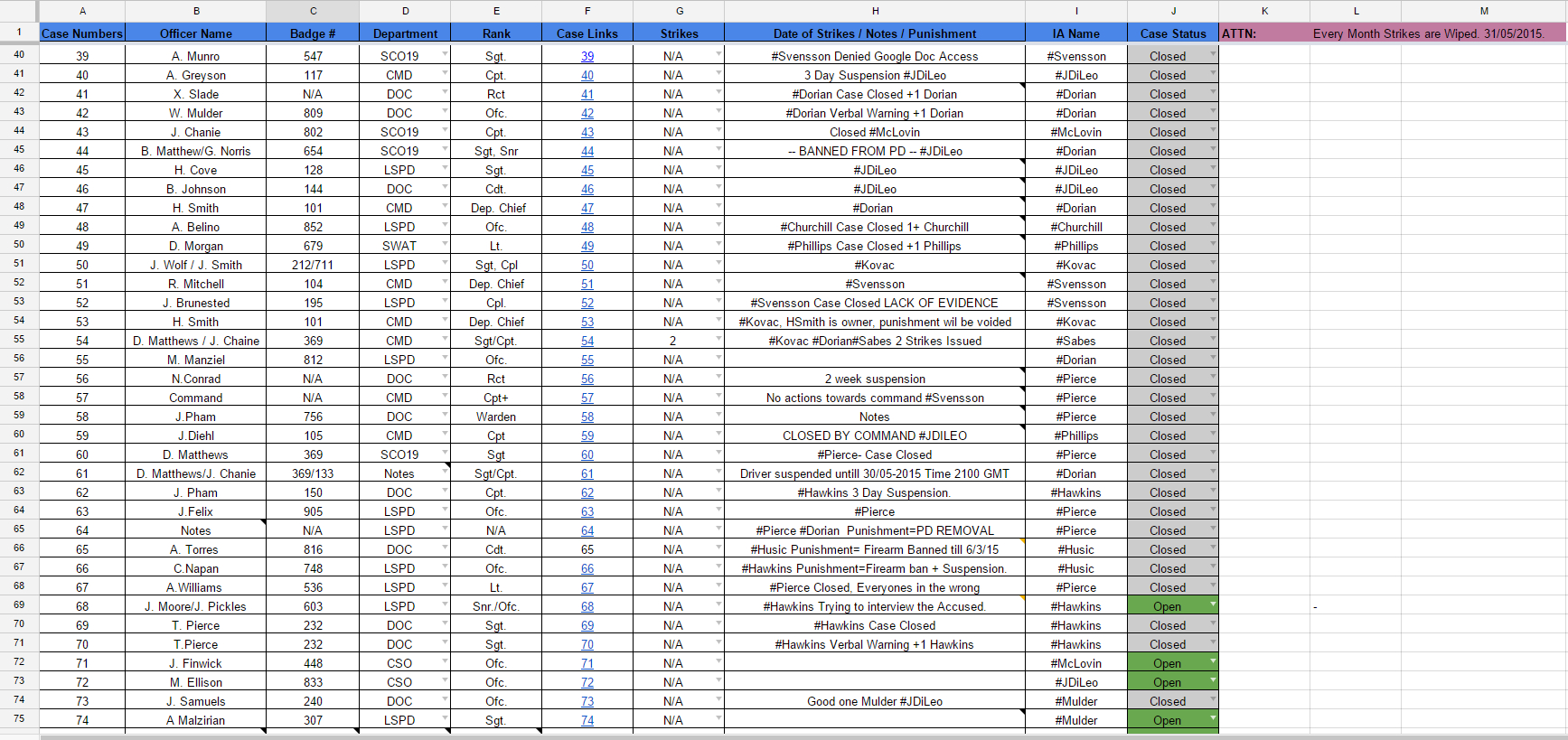

Mortgage companies use these documents for just about every single mortgage they offer. They make money when they find a customer who is interested in getting a mortgage. It’s all about getting people to submit their information.

Looking at the information on these forms, you should see things like your debts and the value of your property. These details are important because they can affect the amount of money you’ll need to pay back on the mortgage. Also if you don’t pay your loan off on time you’ll lose the value of your property. That could cause you to have a hard time repaying the loan.

Certain things to keep in mind when doing a mortgage is that the amount you’re paying out every month could potentially change in the future. That’s why you might be asked to do a debt consolidation plan. This will help you reduce the amount of payments you’re making every month.

A large loan is one that you can’t afford right now. So you may want to consolidate the loans you have into one. This will make it so you don’t have to pay a high interest rate every month.

Sometimes a lender is looking to see if you’re willing to use a new loan to save you from having to deal with your debt again. This can save you money in the long run. Even if it does cost you, if you can use it to save yourself from having a hard time repaying, then it’s worth it.

Before you start signing your mortgage form, you may want to take the time to go online and look at several lenders. You can get an idea of what the rates are and what your options are. You should also look at the fees you’ll have to pay.

The reason for this is so you’ll know how much you’ll have to pay each month. That way you’ll know where you stand financially before you sign anything. This will save you time and hassle later on. YOU MUST SEE : spreadsheet for taxes