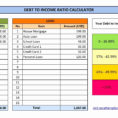

How to create a debt snowball spreadsheet? The best way is by using this formula: Cost of Debt + Interest on Debt – Monthly Payment = Effective Monthly Debt Balances. You can divide your debt into three categories: Interest on debt, cost of debt and the effective payment. Your debt…

Category: Download

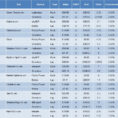

Tenant Rent Tracking Spreadsheet

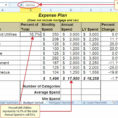

Now, spreadsheets could be downloaded from the web, without needing to cover the program. The spreadsheet will also let you know how much tax which you will pay on the home depending on the funding tax changes, especially Section 24 mortgage interest relief. Household budget spreadsheets are somewhat important for…

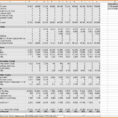

Excel Accounting Spreadsheet For Small Business

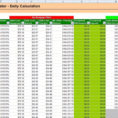

Creating a reliable and useful spreadsheet for small business is very important. This is the key to succeed in the business world. Every day-to-day business activity can be done with the help of a spreadsheet. Your work doesn’t have to be messy anymore. With a good program, you can easily…

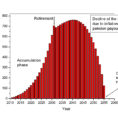

Lay Accumulator Spreadsheet

The templates developed to utilize for saving calculations fluctuates dependent on the saving calculations made depending on the kinds of calculations to be created. They can be used for making CV, resume in order to apply for jobs. An extremely simple budget template can save a great deal of time….

Retirement Income Calculator Spreadsheet

A retirement income calculator spreadsheet can be a really useful tool in the planning of your future. These calculators will help you determine how much money you will need to live comfortably in retirement and also the rate of return that is required to keep your nest egg growing. A…

Mortgage Loan Spreadsheet

A mortgage loan spreadsheet is a spreadsheet that helps you manage your mortgage loan as well as all the other related mortgage loans and personal debt. You may be tempted to invest in software programs that can help you with your mortgage. However, as we are already aware, mortgage software…

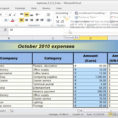

Track Spending Spreadsheet

The templates developed to utilize for saving calculations fluctuates dependent on the rescue calculations created determined by the kinds of calculations to be created. They can be used for creating CV, resume in order to use for jobs. An extremely simple budget template may save yourself a great deal of…