Want to Know More About Sole Trader Accounts Spreadsheet?

Sole Trader Accounts Spreadsheet: No Longer a Mystery

It’s possible to only open savings accounts created for businesses. If you require proper accounts that it is possible to submit to banks and financiers for finance, then we will need to modify the accounts to be able to present them in the appropriate format. It’s possible to borrow from the industry bank account.

Vital Pieces of Sole Trader Accounts Spreadsheet

Some software permits you to give people a remote login and you’re able to control their degree of access. See whether you can sign up to online accounting software at no cost. If you use online accounting software for your company, there are lots of benefits. Now you’ve got a notion of the kind of sole trader accounting software you require, it’s time to choose the best package for you. Sole trader accounting software isn’t only a vital portion of your company.

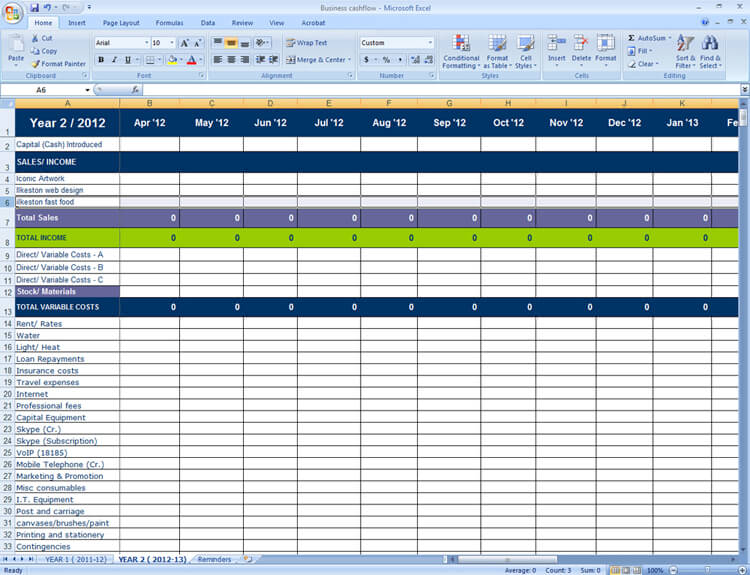

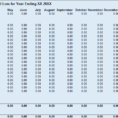

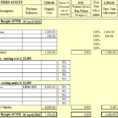

If you can’t find the template that you require, you may choose on the Template Gallery add-on. If you can’t track down the template that you require, you can choose the Template Gallery add-on. A blank spreadsheet template is merely one common type of template employed in selection of explanations. It is just one common sort of template employed in selection of reasons. Utilizing a template helps to ensure that you don’t miss anything important out of your calculations and that the outcome looks like it’s supposed to. It’s possible for you to start out with their absolutely free form templates or you might start out with a sterile form. It’s possible to start with their totally free form templates or you’re able to start with a sterile form.

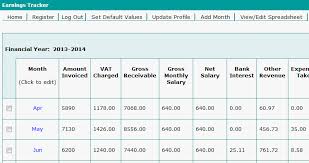

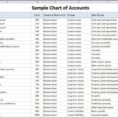

You ought to keep tabs on all your accounts, you will have to guarantee everything is kept including receipts for expenses. You will also need to ensure you maintain tabs on all sole trader income and any expenses. It’s important to keep tabs on when you must submit the mandatory data to HMRC, as missing deadlines can lead to penalties.

Get in touch with us now on 03 9832 0900 to find out what can be done to genuinely move your organization ahead. Even if the company is owned and run by just 1 person a business may still be a limited firm. As the company gets more established, you’re going to be in a position to acquire a better comprehension of how much you have to set aside each month. As your company grows and you get started employing people the advantage of separate legal liability increases.

In order to acquire money from the organization, the business must offer employee salaries or declare dividends on any profits to shareholders. It will need to be registered with Companies House who will provide an incorporation certificate showing the company number and confirming the company is now a legal entity. You might not have incorporated you company once you made the buy, but should you keep copies of the receipts you’re able to claim relevant expenses. Additionally, a limited business can claim for a larger array of allowance and tax-deductible costs against its profits. It can register a company name and no one else can then use it, whereas sole traders are not able to access the same protection. If you’re a self-employed sole-trader rather than working for a limited company, you are still able to get tax relief on your organization assets, including laptops.