Making a small business tax spreadsheet is something that every small business owner should do. Every owner wants to have as much cash as possible in the bank, and a tax-efficient accounting system is one of the keys to this goal. The information in this article will help you make a small business tax spreadsheet.

First, download your business’ current income tax information into a file in money management software such as Excel or QuickBooks. You will also need information for the business expenses, sales and other financial information.

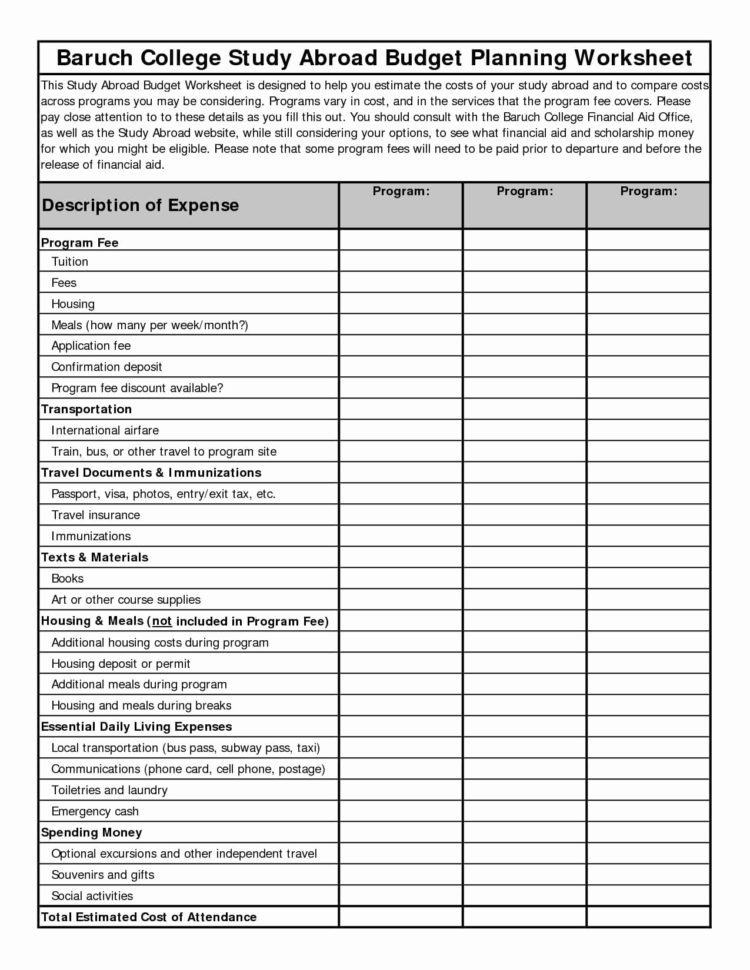

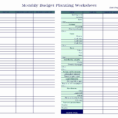

Once you have those files, you will want to open the tax tables and enter your budget for the year. Enter in all your individual income, which will be what you will later include in your tax document.

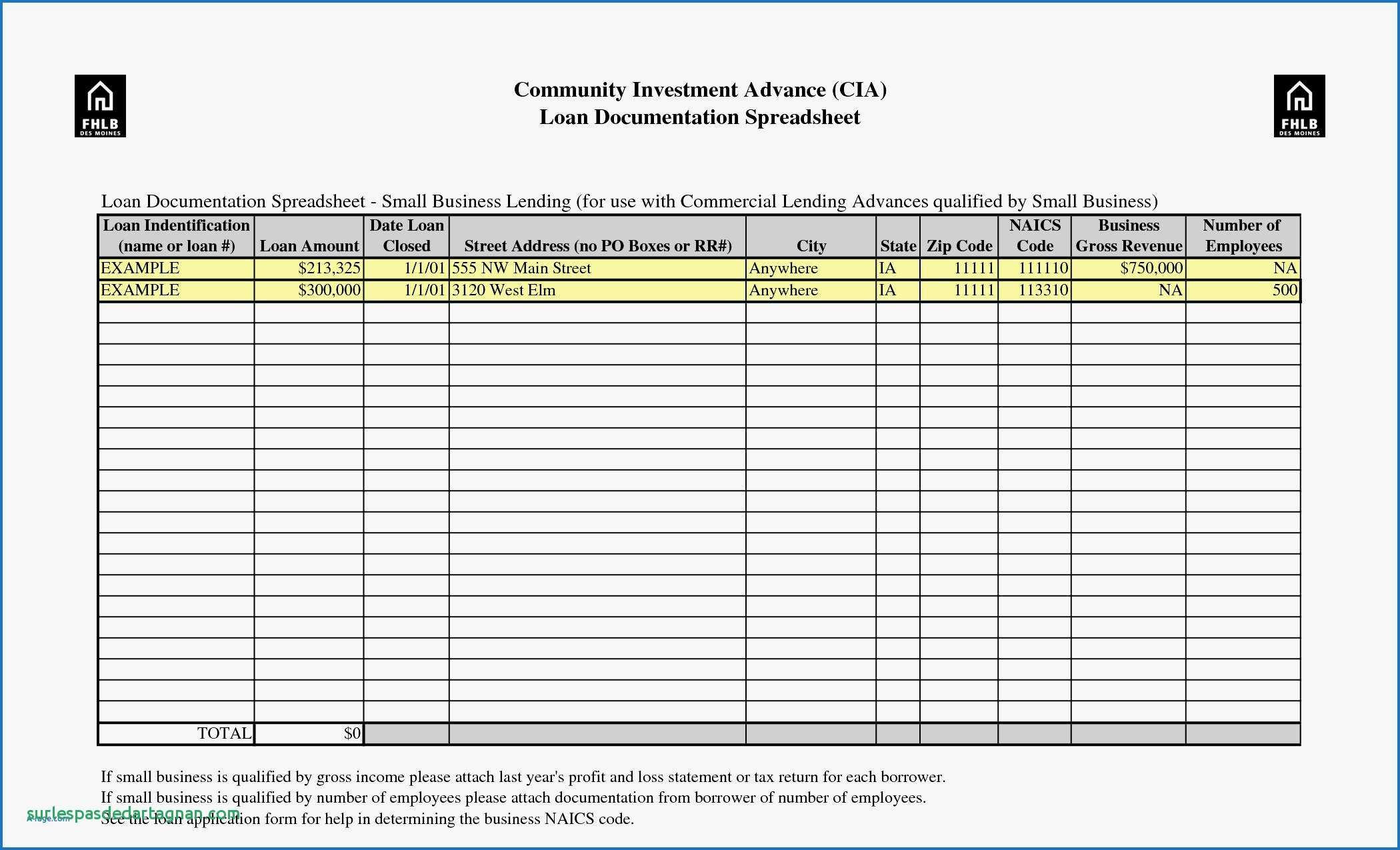

Small Business Tax Spreadsheet

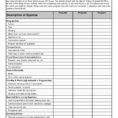

Next, enter all your personal deductions. It will include expenses such as clothing, healthcare, and home maintenance. Also, consider any health savings account deductions.

You can use the tax forms to learn about what is included in the price of items, and the total amount of income or expenses for the year. You will also need to learn about any taxes paid on the capital gains. Be sure to put in the costs associated with business purchases.

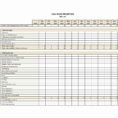

Now it’s time to enter in the income for each employee and assess income for other company employees. This includes any dividends that the company pays and can be calculated by subtracting salary from the sales figures. Be sure to include expenses in this formula.

Finally, enter all sales figures, and if there are any customers, enter them here as well. In the margins section, you can enter in an income and expense formula for the purpose of itemizing, and here is where you can write down any taxes that were paid during the year. Be sure to include these as expenses in your personal taxes.

At this point, the only remaining step to this worksheet is to add in the totals for all of the sales for the year. This will give you a good picture of the total cash flow for the business, and how your company has spent its income for the year. Be sure to include depreciation, and all capital costs.

At this point, your small business tax spreadsheet will already contain most of the important information you need to get your taxes taken care of. However, some tax provisions and fees do not have to be included in the small business income and expenses calculation. As an example, the interest paid on debt is usually not factored into the equation.

There is, however, a way to get these things included into your small business tax calculator. To do this, you will need to hire a tax consultant. They will use a specialized software program to fill in all the parts of the worksheet that you don’t currently know about.

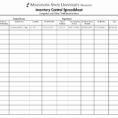

The small business tax calculator is the best tool that every small business owner should have. By using this important tool, you will have better control over your tax strategy and tax payments. YOU MUST LOOK : small business spreadsheet

Sample for Small Business Tax Spreadsheet