An Overview of the Small Business Income Expense Spreadsheet Template

The small business income expense spreadsheet is a wonderful tool that anyone can use to start investing in their future. This template can be used for personal use or for business use.

As a free document it can be used for personal use. You will not be able to claim any profit as a result of using this spreadsheet but it will provide you with valuable information about your income and expenses. In order to use the template for business use, however, you will need to acquire a copy from the owners of the software.

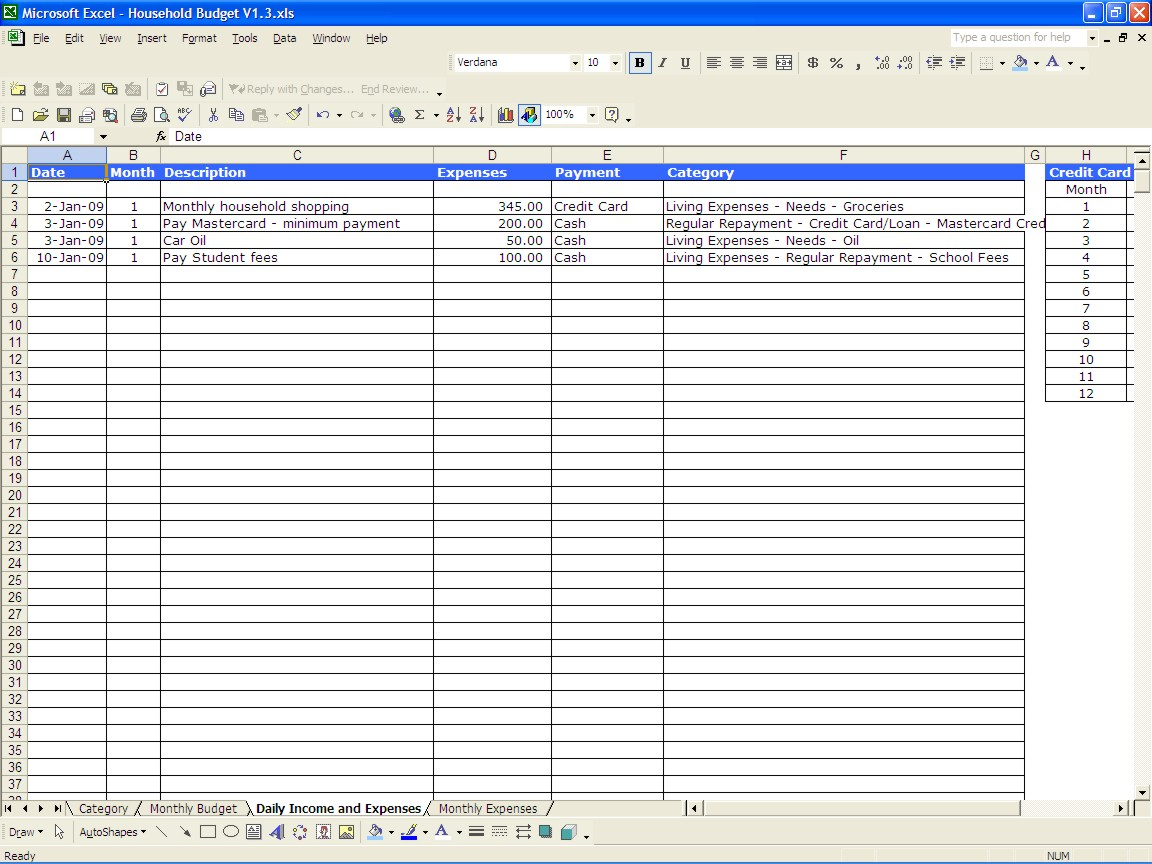

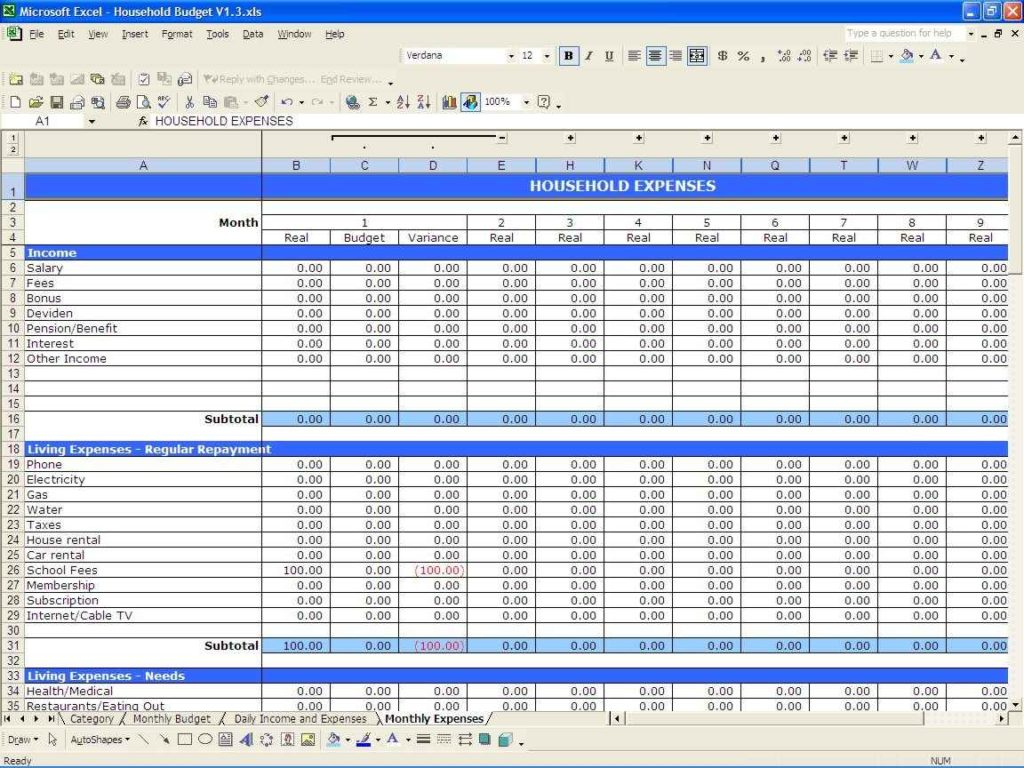

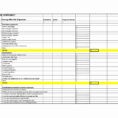

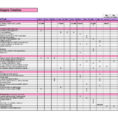

There are three parts to the sheet: the income column, the expenses column, and the balances column. The income column is where you input the information that you receive from your customers. For example, if you receive an income of $1000 per month and you sell a widget to your customer, then your income and expenses would be $1500 and $100.

Items in the income column include your gross revenues and your expenses. For example, let’s say that you are selling products in a store for which you have a marketing budget of $1000. Your expenses include all the costs of product running, such as shipping and marketing costs.

In addition to the income and expenses, you also enter the gross profit for the month in the small business income expense spreadsheet. The spreadsheet will calculate the gross profit based on your sales of widgets, minus all the expenses associated with those sales.

With a small business income expense spreadsheet, you will be able to track the details of your income and expenses. You will be able to analyze the statistics and trends for this period. You will know exactly how much money you have earned and how much money you have spent during the last month.

In order to successfully make use of a small business income expense spreadsheet, it is important that you are meticulous when writing down the information. If you do not follow the instructions carefully, then it is likely that you will lose valuable information. And if you do not get your job done, then it will be even more difficult to track your progress.

The revenue column is where you enter the data for the month. For example, you might enter the information such as the gross revenues from the last month. The income of your customers can then be calculated based on the gross revenues you received from them. You may even enter the gross revenues you received from other sources that have not been included in the gross revenues column.

The expenses column is where you input the expenses that you incurred during the month. The expenses can include only one or both the income and the expenses columns. The expenses can include both the income and the expenses columns.

To enter the revenue and expenses, you simply use the enter key and the value that you entered in the income expense column. But what if there is more than one entry for each item? In that case, you should be careful about the formatting of the spreadsheet because you will want to ensure that it is readable.

The small business income expense spreadsheet template is a great resource for anyone who wants to track his or her income and expenses. You will be able to enter the numbers, track your progress, and see the trends over time. All you need to do is to follow the instructions. LOOK ALSO : small business income and expenses spreadsheet template

Sample for Small Business Income Expense Spreadsheet Template