All About An Income And Expenses Spreadsheet

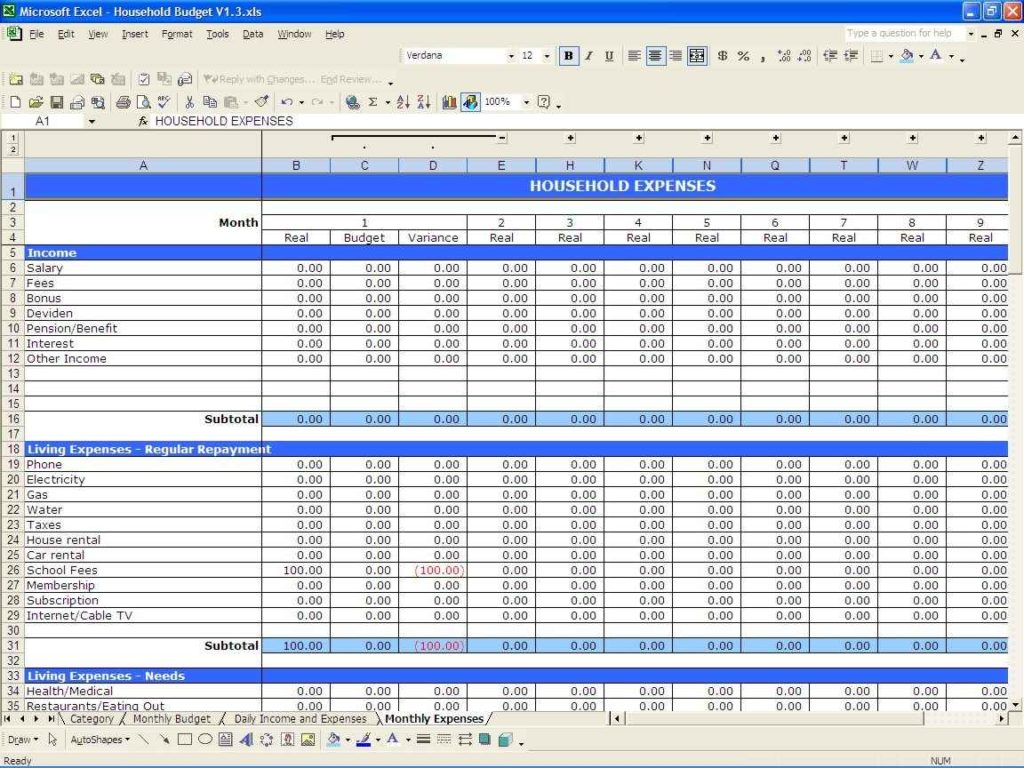

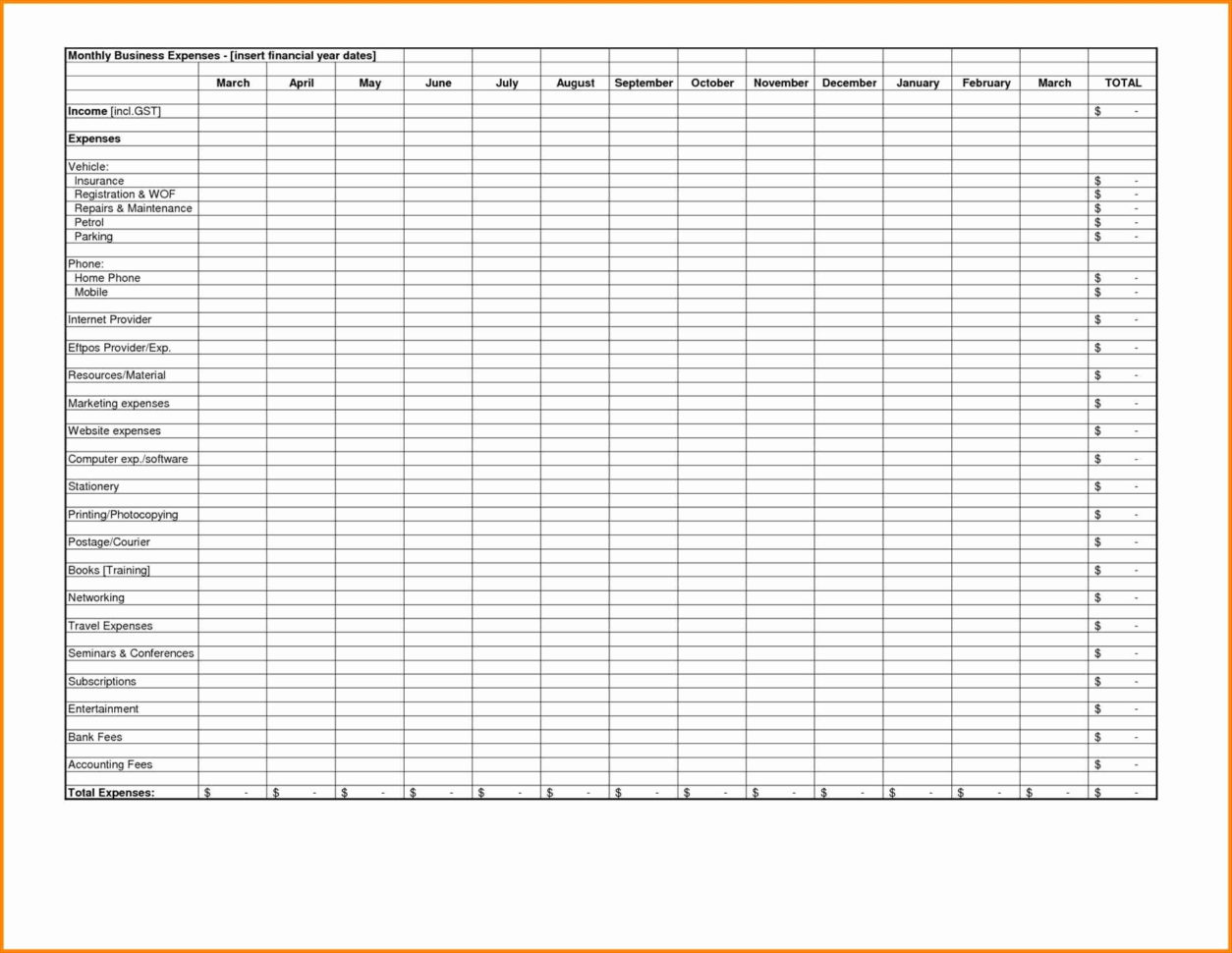

An income and expenses spreadsheet are a very helpful tool for those who have started out with a small business. This is especially important for the entrepreneurs who had to start it from scratch.

Starting a business is no easy task. It may be a challenge but once it’s off the ground, things should be just the same as other ventures. What’s more important is that the entrepreneur should also monitor the growth of his business.

A small business income and expenses spreadsheet will serve as an important tool to track the ongoing progress of the business. Of course, there are many reasons why you would want to keep a record of all your transactions. Here are some reasons why you need to make sure that you include those details in your business income and expenses spreadsheet.

It is important to have a record of all the new customers. After you have made a great amount of profit, it is important to keep a record of how you have managed the money. By including all the financial details, you are sure to create a good record. You can also add your accountant to the list of people that will have access to this information.

The next thing you will want to do is to check the accuracy of the information that you have. If you know that there are errors, you will want to avoid them by adding the wrong entries. To make things simple, you can just change the dates in the spreadsheet. However, do not forget to update the figures, because you don’t want your accounting to be in a mess.

This will have a big impact on your business. This is especially true if you are worried about tax. In this case, you should check whether you are giving the correct amount of income tax to the government. That’s right, you need to pay all your taxes to the government. However, sometimes your income records are in chaos.

It can be hard to verify whether you have the correct data or not. However, this is the time you need to prove that you have accurate and up-to-date records.

This is why you need to make sure that you have everything at hand. Of course, this includes the software that will enable you to create the spreadsheet. Otherwise, you may end up losing your hard-earned profits due to incorrect calculation.

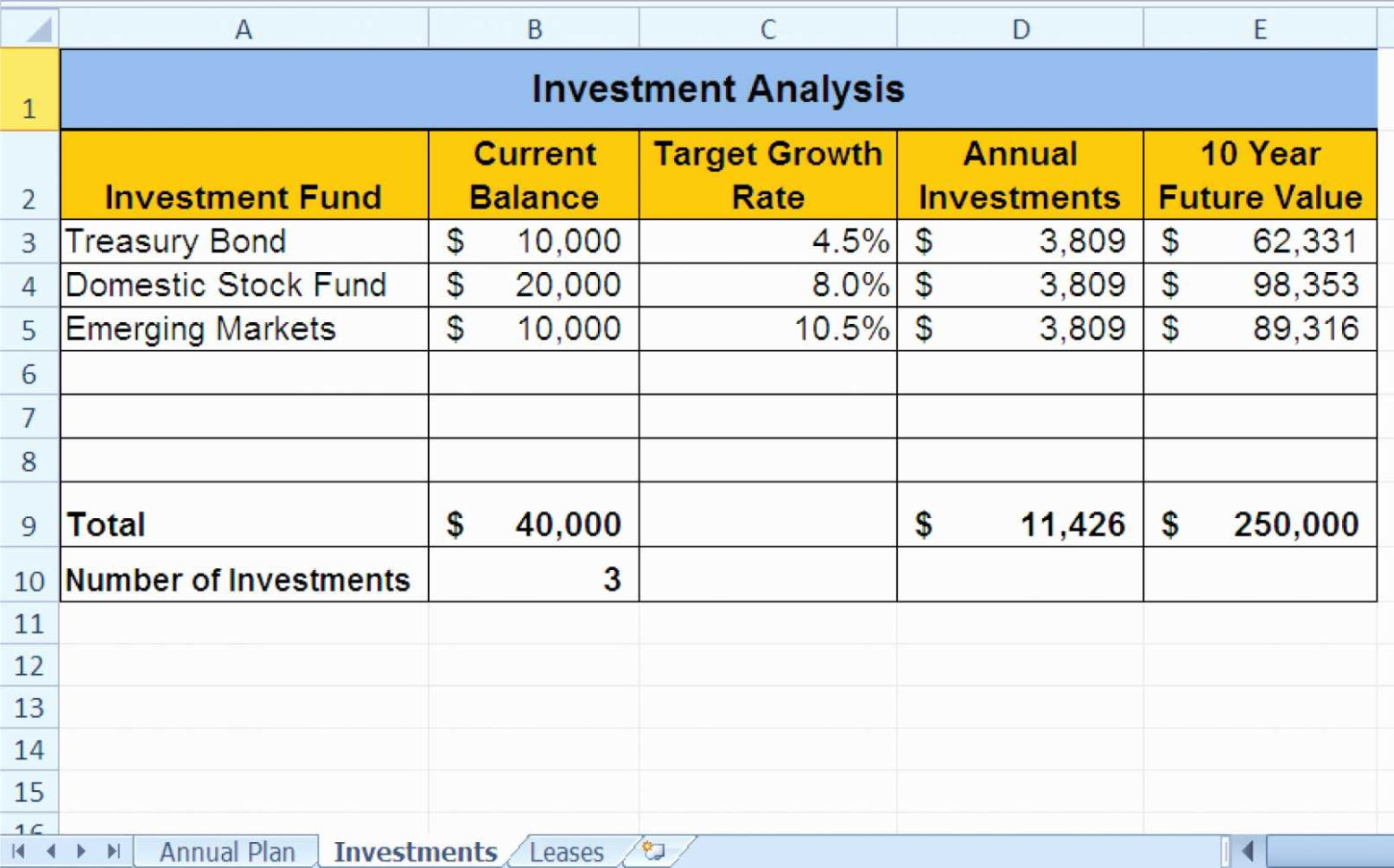

Also, having these records is a great help in setting priorities. For example, you should also check if you are going to save the tax for this year or the next. This will help you save more money in the long run. You might even consider setting up an investment account so that you can withdraw some money to increase your capital.

The first thing you need to do in creating a business income and expenses spreadsheet is to find a reliable source. This means that you need to invest some time to find one that offers great support.

When you want to build your own products, you have to spend a lot of time. With the help of a good software, it’s much easier for you to get your work done. This is the reason why it is highly recommended that you hire the services of one. SEE ALSO : small business general ledger template

Sample for Small Business Income And Expenses Spreadsheet