Small Business Expense Tracking Sheets Are Great Tools For Organizing Your Finances

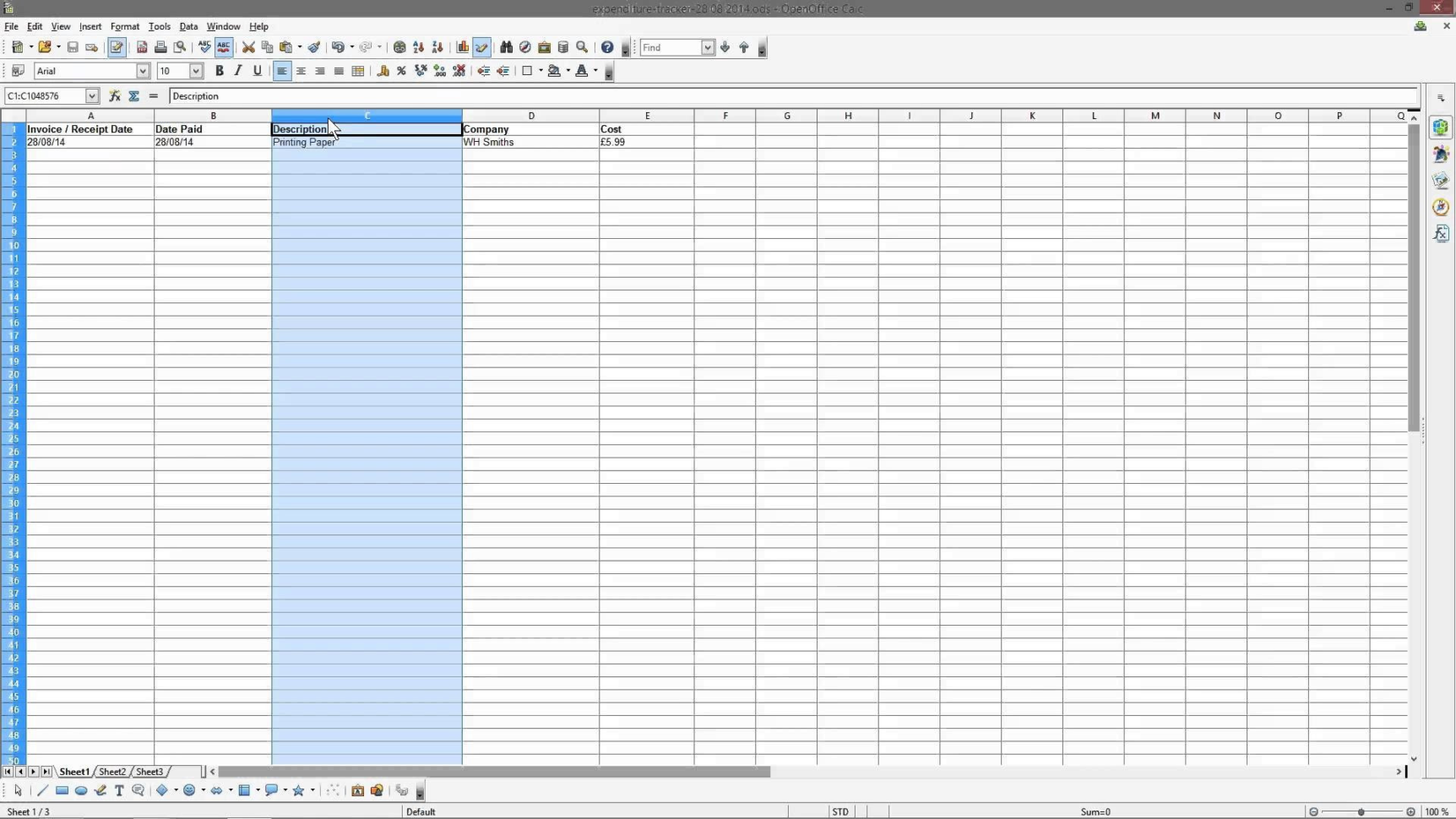

If you’re a small business owner and want to make sure that your records are up to date and correct, then perhaps it’s time for you to use a small business expense tracking spreadsheet. These small sheets of paper can be used to keep track of all the paperwork that you will need to send to accountants.

You would realize that spending money would get you in trouble every now and then. And the same goes for record keeping. Although, there are some businesses who cannot afford to spend big amounts of money, yet they need to keep records.

But, since the time has come when making business expenses is not required, it is very difficult to maintain them. Also, when you use a small expense tracking sheet, you would be able to clearly tell what has been spent and what was not. You would also be able to see the effect of mistakes that you may have made.

And because these business expense tracking sheets are pretty simple to use, most people can use them without much hassle. When you are a business owner and your company requires certain expense to be paid, it is necessary that you send receipts to the accounting department. That way, you would know where the money went and what went wrong with it.

As a business owner, it is not a good idea to write down every single payment that you make to certain paperwork, especially when you are not sure whether that particular payment was made on time or not. For this reason, it is essential that you make use of a small business expense tracking spreadsheet. One will need to make the data easy to read and easily available.

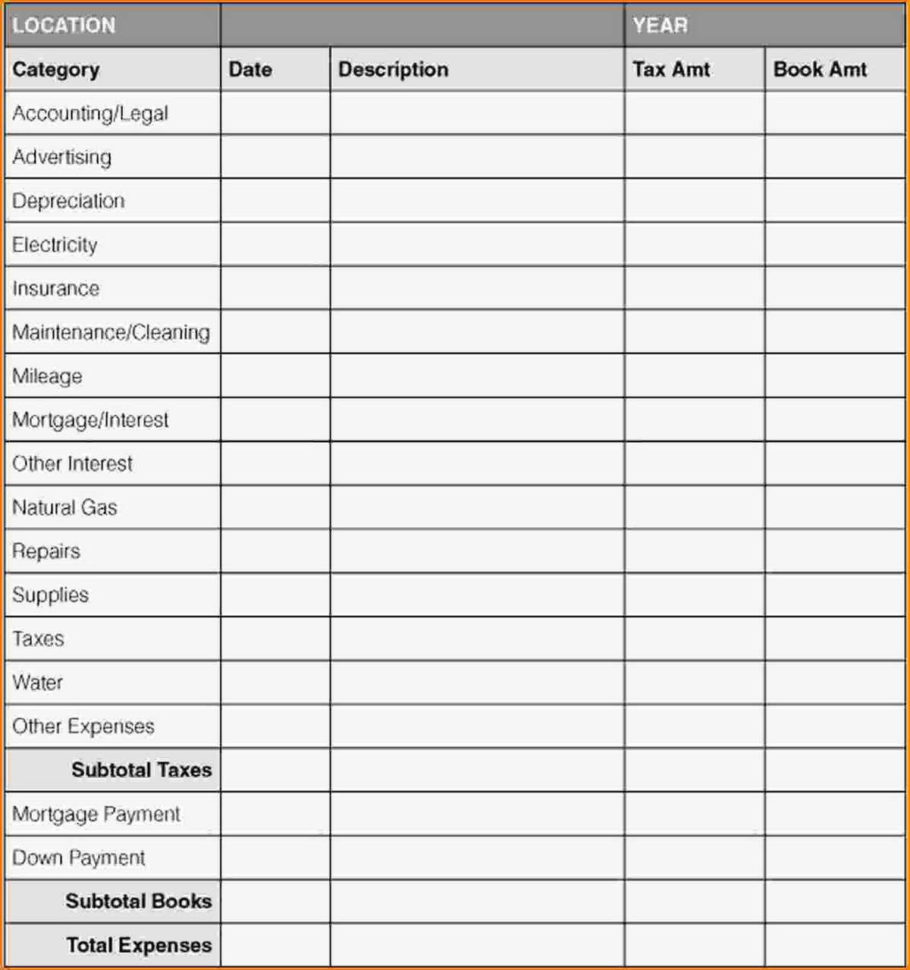

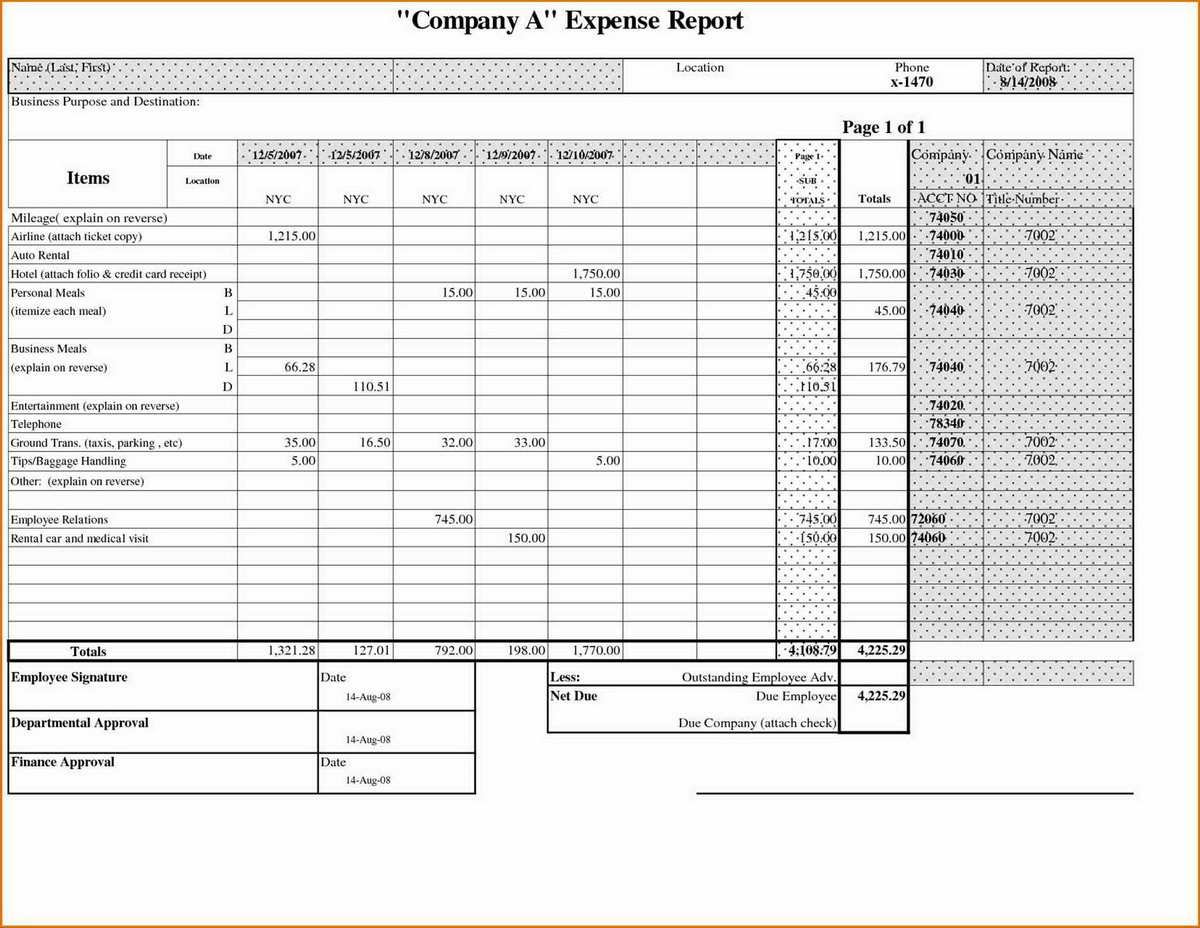

You could use a small business expense tracking spreadsheet to generate sales reports, quarterly reports, and year-end reports. These financial reports can include sales, sales and cost of goods sold, profit and net income, and many other factors. You would notice that any business would surely benefit from using such a sheet.

You would also have the opportunity to trace such expenses to their source. Once the information on sales is gathered, you would then be able to see how the purchases and sales that were made have contributed to the revenue of your company. A small business expense tracking spreadsheet will also help you evaluate the effectiveness of such purchases.

Aside from this, you could also view the possible ways on how to improve the effectiveness of such expenses by using such a small business expense tracking spreadsheet. It would also give you the opportunity to track expenses made to other businesses, which may bring in profits.

You would also be able to find out if there are any bad habits in handling finances, especially with regards to small business expense tracking. For instance, you may notice that there are still a lot of payments that may go unpaid for. In such a situation, you would also be able to create an effective action plan.

The smallest expense tracking sheet will be able to assist you in making many calculations, especially in the field of taxes. The more complicated the calculations become, the harder it would be to implement and control. This is why it is important that you use the simple and basic expense tracking sheet that can simplify and organize your finances.

Using such a financial document would also help you in keeping your records clean and in check. It would also allow you to have an objective view of what is going on in your business. Small business expense tracking sheets are great tools for keeping your business finances organized and on track. PLEASE READ : simple sales tracking spreadsheet

Sample for Small Business Expense Tracking Spreadsheet