Business Expense Sheets – The Importance of Business Expense Sheets

If you own a small business, chances are, you have already heard of small business expense sheets. They are a common practice for a lot of businesses today. They provide a logical way to track and control small business expenses.

Any owner who owns a business must have a business expense sheet. These expense sheets are important because they help to record the expenses that are incurred, when they are incurred, and for how long. They also include the information that is required by law to be included on expense sheets.

There are many types of small business expense sheets that can be used. Some companies choose to use a standard expense sheet, or they can choose to create their own. This is done either by using their own software or by purchasing an existing company’s software. Either way, the business owner and their accountant will need to review all of the expense details.

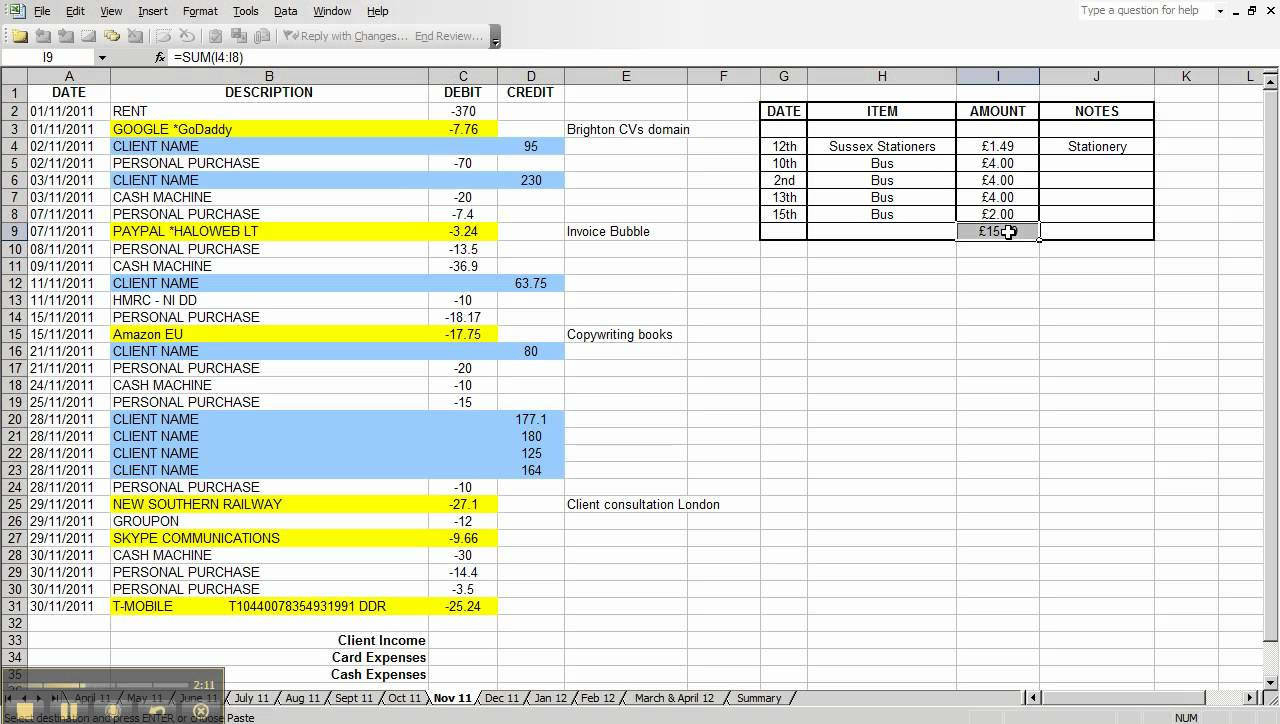

These basic business expense sheets include; which items will be charged, when, and the total amount of those charges. Some companies prefer to use expense tracking software. This allows them to use a simple checkbook that contains the entire business expense history. Most of these software products require the use of an accounting system, but they have many different features and benefits.

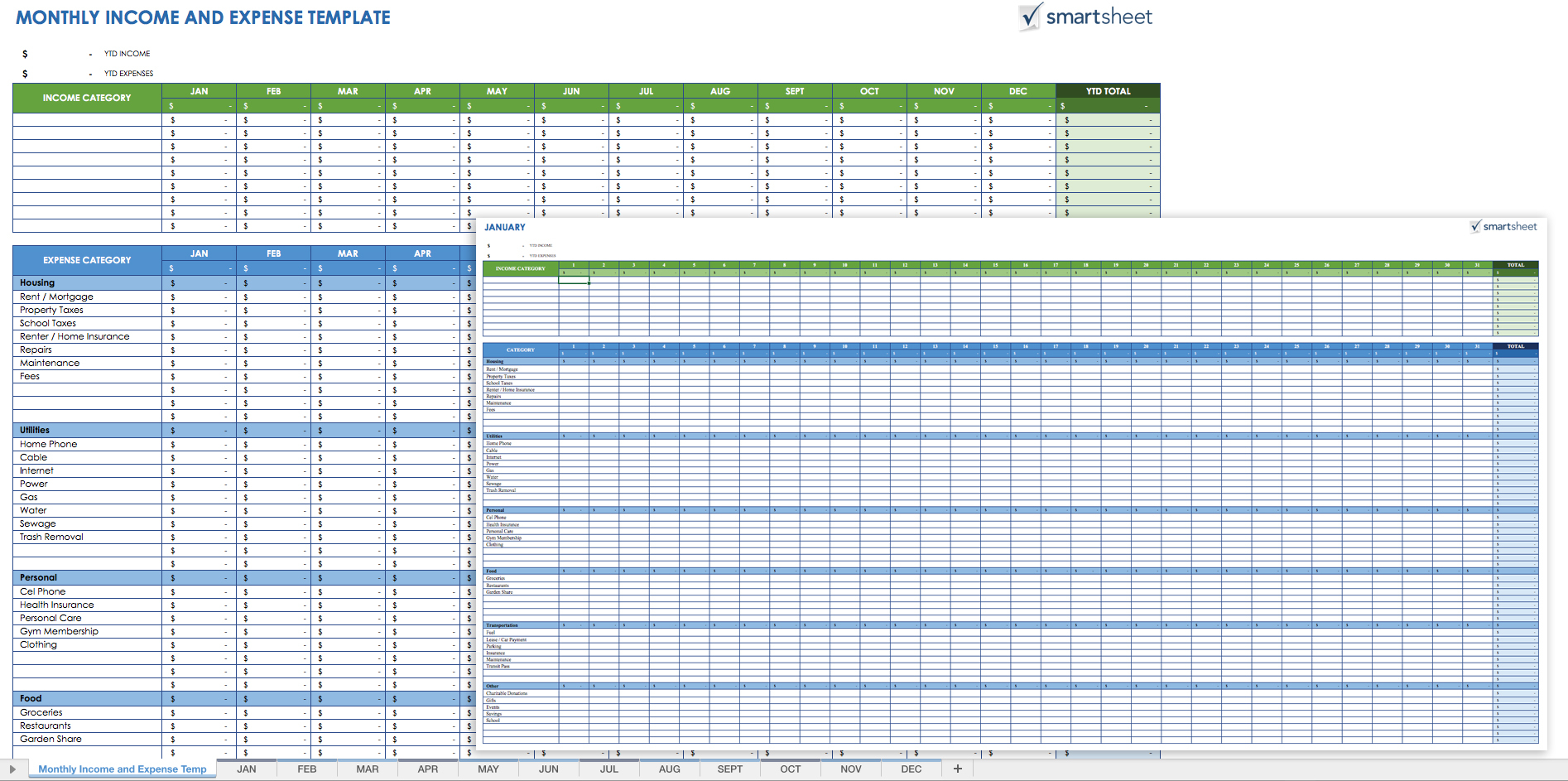

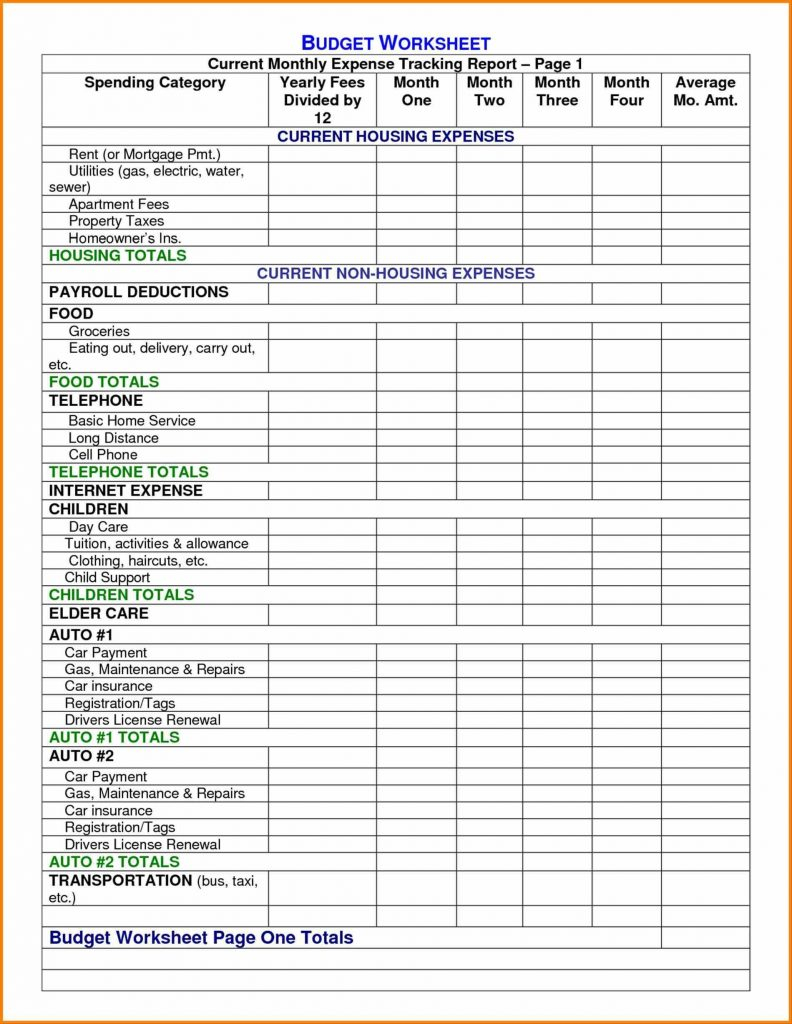

The majority of business expense sheet templates are designed to generate reports and bar charts that are easy to read and understand. This allows the business owner to make changes to expense amounts, amounts charged, dates of charges, types of charges, locations, and payees.

Most small business expense sheet templates also have the capability to generate a checklist. For some businesses, the business owner may simply want to have a list of expenses and the date of when the expense was incurred. Other companies may need to have an additional list of items to check off and when the date of the check should be subtracted from the actual date.

Small business expense sheet templates also have the ability to track time, dates, and many other things. Other businesses may need to have time tracking, customer and employee tracking, cash flow tracking, and many other types of time and cash flow reporting. There are many options available, and they are simply a matter of finding what your needs are.

The average small business expense sheet templates will have more than just the date and time of when the expense was incurred. They will have details of payment, the payment date, a rough estimate of cash flow, and a list of everything listed on the expense sheet. Many times these expense sheet templates will also include an itemized statement.

Another useful feature in small business expense sheet templates is the capability to create a report of income and expenses over time. These reports can include the current income and expenses that are part of the business. This is a very valuable tool, because it allows the business owner to compare his/her current income to previous years’ expenses.

The small business expense sheet templates are designed to be simple and easy to use. The result is an extremely useful item that allows the business owner to quickly organize and see what expenses are coming from their business. It is a simple yet effective way to manage and control the expenses of your business.

Small business expense sheet templates are very easy to use, so be sure to make sure that you take the time to understand them. You can create one for yourself or use one that is ready to use. READ ALSO : small business expense and income spreadsheet

Sample for Small Business Expense Sheet Templates