Learn Simple Bookkeeping Spreadsheet

You may have heard about “simple bookkeeping spreadsheet” before. It’s just one of those new accounting tools that seems to pop up every now and then. But, it is nothing new. In fact, there are many old-fashioned bookkeeping tools that you can learn from.

First of all, don’t just rely on your good old ledger with the ledger of your income and expenses as the only reference to your company’s accounts. You will need a better reference than that for your company’s accounts. A simpler and easier way of doing business is using a simple bookkeeping spreadsheet.

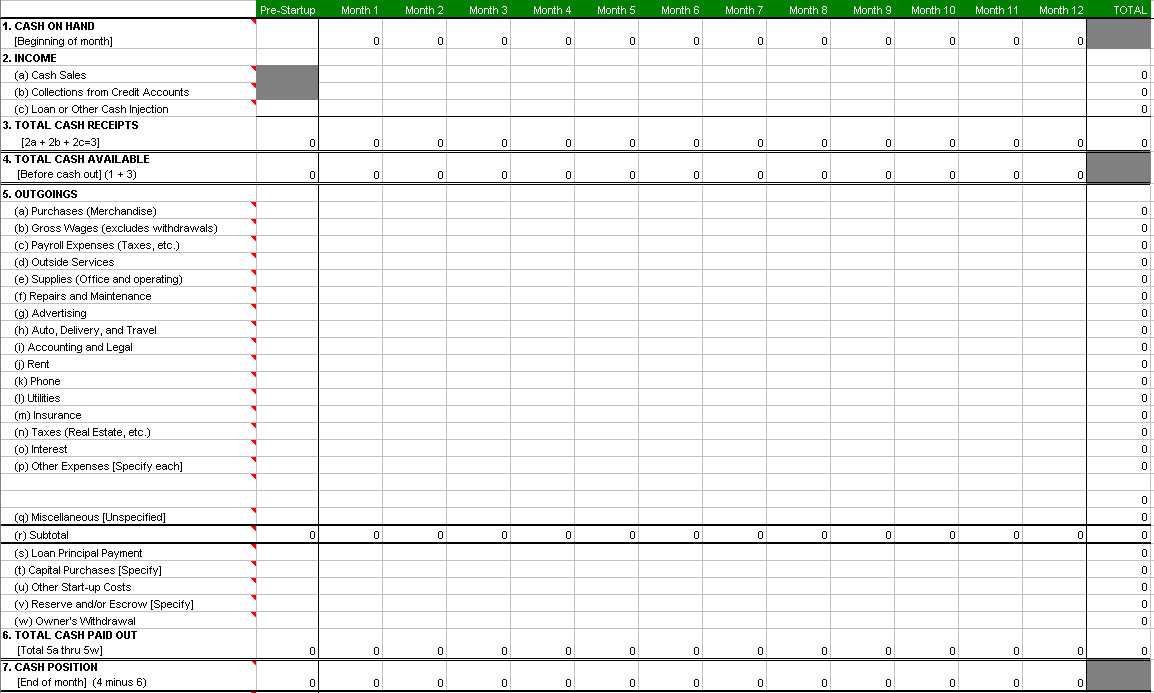

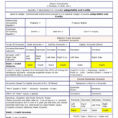

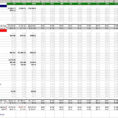

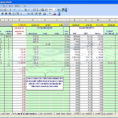

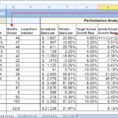

Example spreadsheet: This is a simplified version of an Excel spreadsheet. In this example, each line has a column containing values for the beginning of the period. The bottom-right column contains the corresponding values of the end of the period.

Correct cost is written in column C of the Excel spreadsheet. Therefore, you can simply follow the rules for calculating your correct cost.

Column B is the amount of capital stock. You may not have an effective tax rate, but the capital stock is the one most people look at. You have to realize that some businesses require more capital stock than others.

Then, column C is the effective tax rate. The tax rate is written in red, and the percentage that is being applied to the profit and loss account is written in blue. Because you can view all the entries in the Excel spreadsheet, it’s very easy to compare the results of two different tax rates.

Column D shows the deductions. With the right amount of deductions, you can earn a more favorable tax rate. The deductions can be a percentage of the amount of profit that is earned or simply are items such as deductible interest, casualty losses, depreciation, etc. There are too many deductions to list here.

Column E shows the gross profit. To determine the difference between the gross profit and the book value of the business, you can find the difference in the formula that Excel uses.

Columns F and G represent sales and purchases. What the sales columns shows is the dollar amount that is made in sales or the dollar amount that is made by the purchase of goods or services. It should not be used in the calculation for book value because these prices aren’t the same as the sales price. The book value includes the book value that is part of the intangible asset’s tangible profit.

Column H is profit. It is the value of what you got paid in dividends and the value of the rest of the capital stock.

These are the three important columns of a simple bookkeeping spreadsheet. To simplify your work, try to keep track of these three columns in an Excel spreadsheet. Then, you will see that the three important columns of an Excel spreadsheet are easy to learn and easy to understand. SEE ALSO : samples of bookkeeping spreadsheets

Sample for Simple Bookkeeping Spreadsheet