The Confidential Secrets for Simple Accounting Spreadsheet For Sole Trader Discovered

Sole Trader is ideal for you. A sole trader is accountable for the liabilities of the small business. He is entitled to keep all of the profits the business makes after paying all of the taxes that are due on it. He is the simplest form of business structure and is relatively easy and inexpensive to set up. He does not need to keep accounts, but it should ensure that it has registered the business with the relevant tax authority. Sole traders and partnerships may also enjoy tax savings in regards to supplying benefits in kind.

You only need to register your small business name once. Altering your company name doesn’t impact your legal name. You don’t need to register for a legal name for your company.

If you would like your business to trade below a name that’s different from your legal name, then you are going to have to register a business name with the ASIC utilizing the Business Registration Service. It’s simple to set yourself up as you simply must declare to yourself you are likely to be an enterprise. The company is classed as a micro-business, small company or SME, as they simply have one employee who’s the person who owns the business. Understanding common businesses operated by sole proprietors are able to help you decide if it’s the appropriate structure for you.

The owner must be responsible for all of the debts of the small business. You may also have to think of what would occur if you as the business owner should happen to become sick or had an accident so that you couldn’t get the job done. Whoever owns such company is called sole trader.

Want to Know More About Simple Accounting Spreadsheet For Sole Trader?

The organization must register the company name Ace Consulting’. If simply providing consultancy solutions, for instance, then a limited company may be unnecessarily intricate. Limited businesses provide a different set-up altogether. In the majority of instances, a sole proprietor operating a catering company should employ employees.

You don’t need to use simplified expenses. There are several sorts of expense that you could claim and HMRC have just produced a new guide Many small business owners incur in costs before they actually start in operation. Simplified expenses are a method of calculating some of your company expenses utilizing flat rates rather than working out your true small business expenses.

The Secret to Simple Accounting Spreadsheet For Sole Trader

See our Registrations topic for more info about what to register for your industry. The business doesn’t exist in the view of the laws. A sole trader business has many benefits and disadvantages.

You are able to just decide whether it suits your organization or not. As a Sole Trader, you still ought to manage your organization professionally. If you’re a startup business, researching your market makes it possible to develop your small business idea, initiate fantastic practices from the beginning and position your launch to draw the attention of your intended industry.

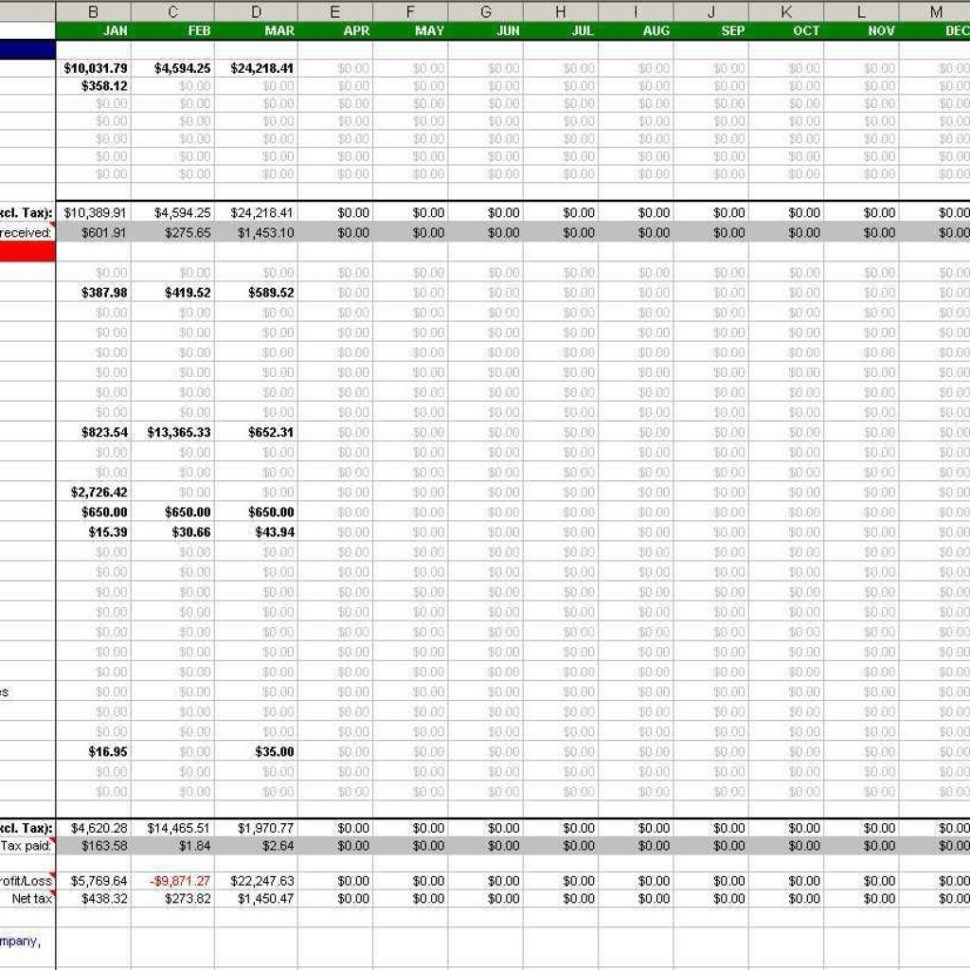

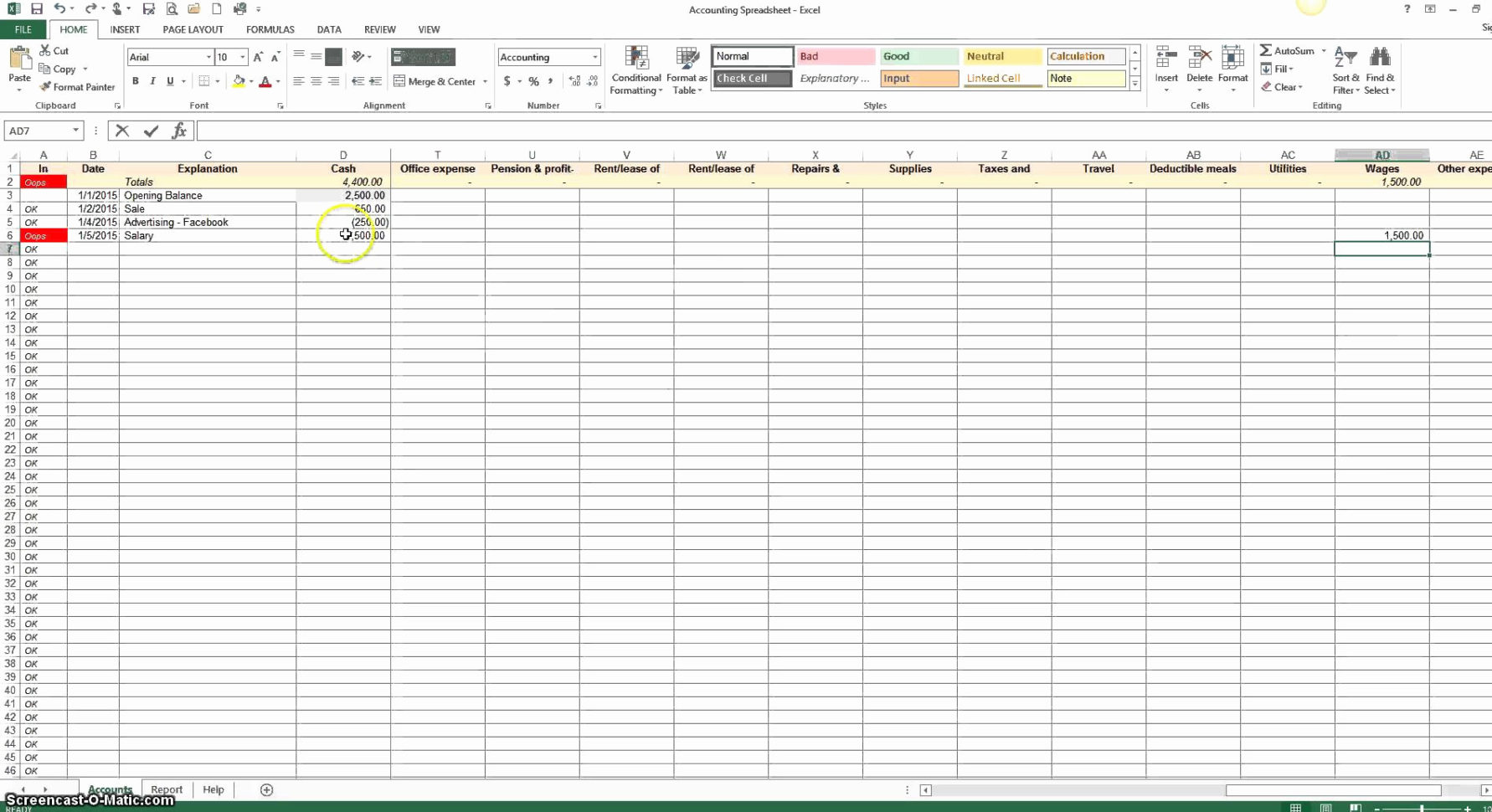

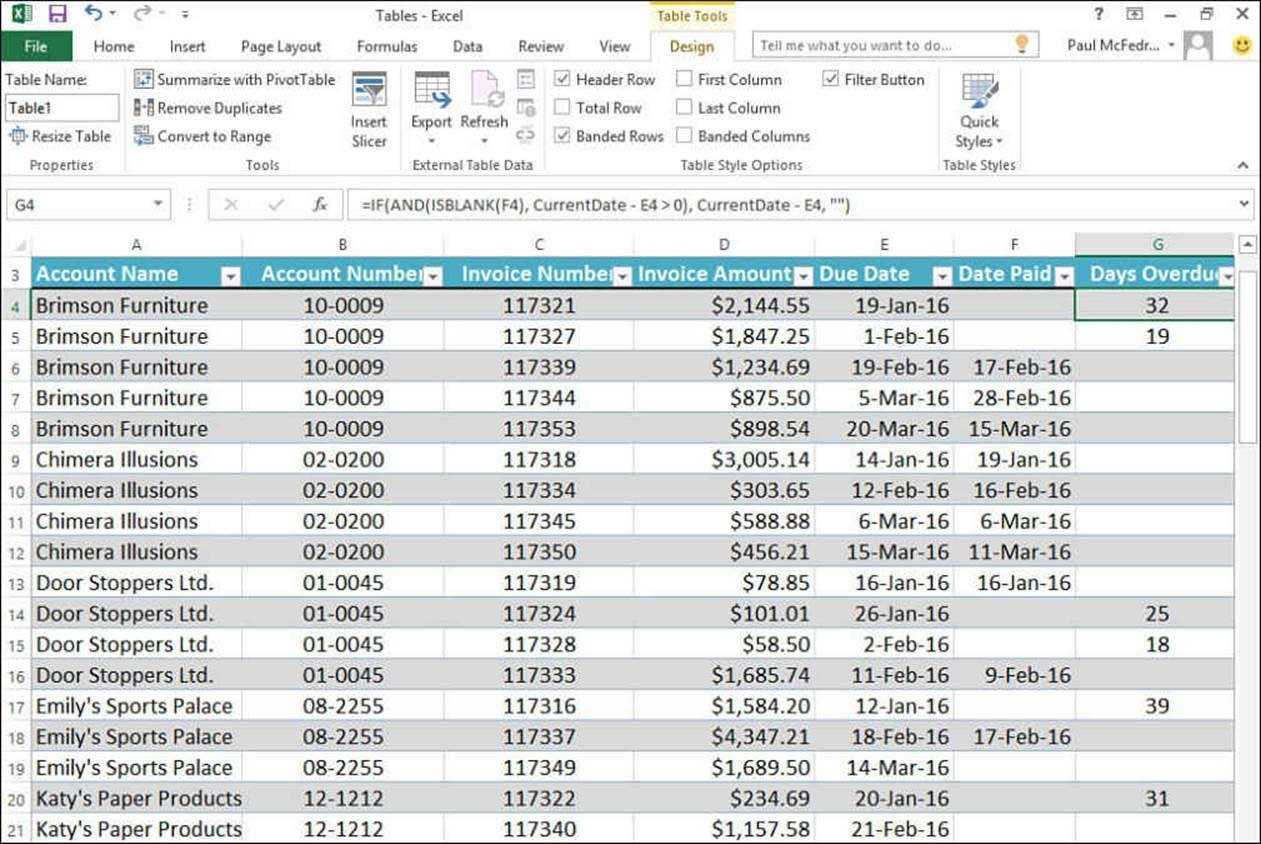

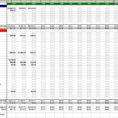

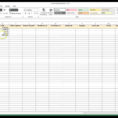

Sample for Simple Accounting Spreadsheet For Sole Trader