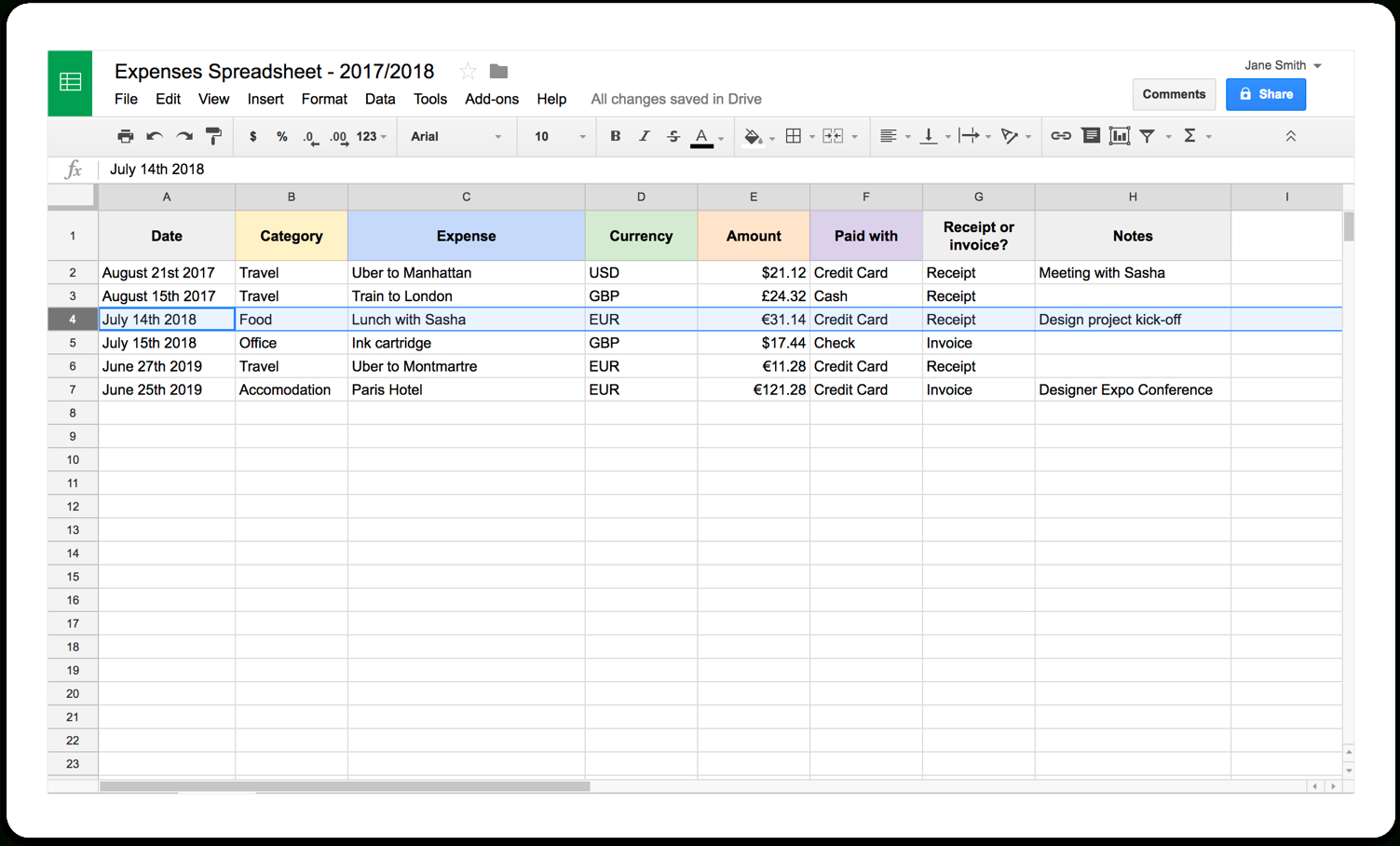

Do you need to make a self-employed expenses spreadsheet? Self-employed persons usually use these types of expenses for tax purposes. By making this type of expenses spreadsheet, you can easily calculate your tax liability.

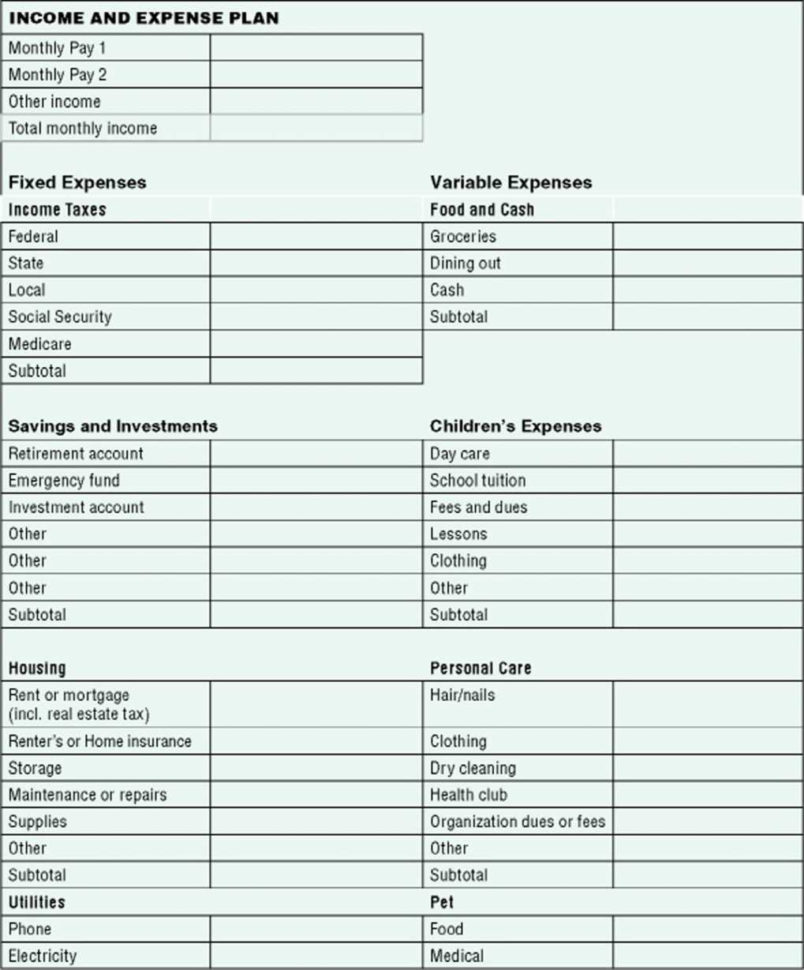

The expenses are actually quite simple to do and can be done without a lot of hassle. All you have to do is to work on some of the common categories of self-employed expenses. The categories include business expense, travel expense, office supplies, business income, other expenses and even miscellaneous expenses.

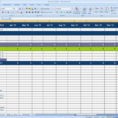

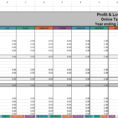

Self Employed Expenses Spreadsheet

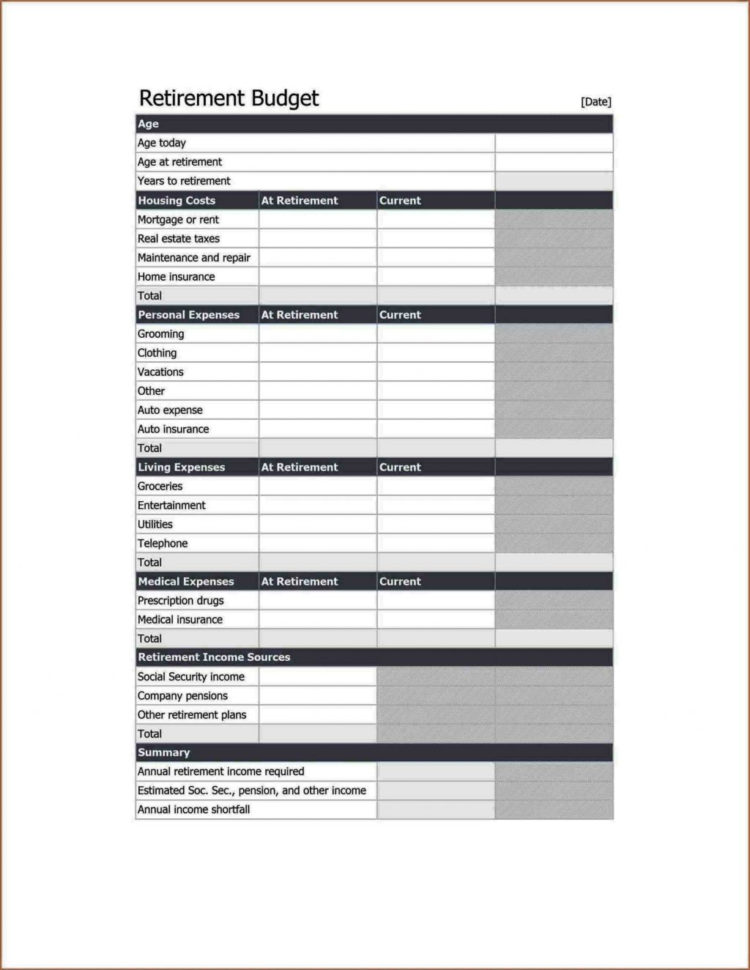

When it comes to business expense, this includes your operating expenses. This can include rent of office space, goods you buy or even your transportation. All these things will have to be tallied in this category.

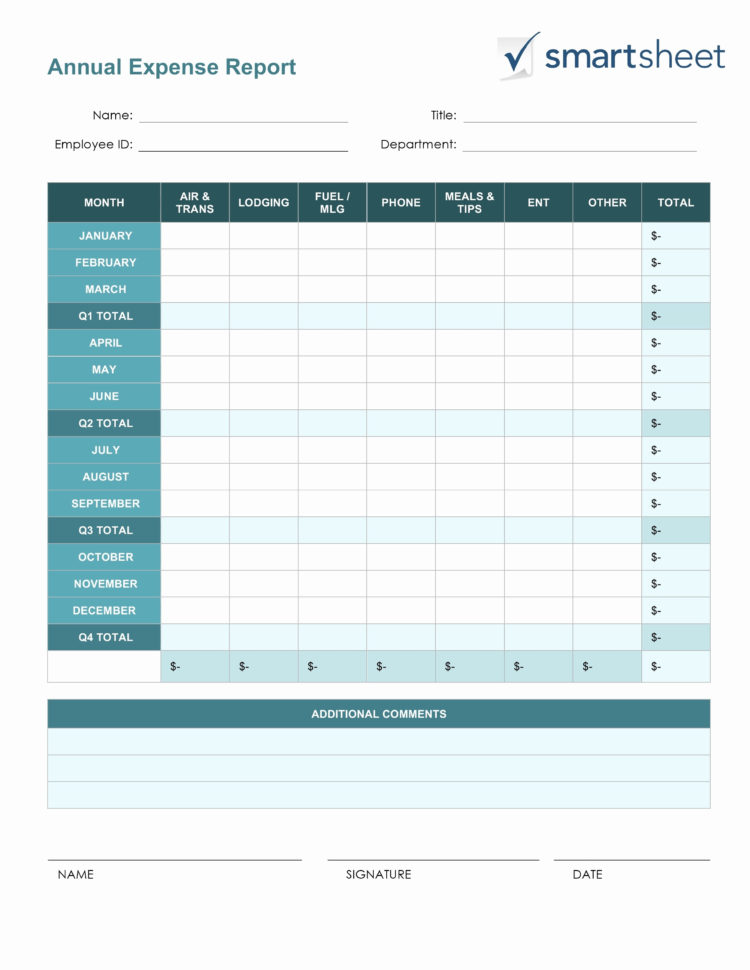

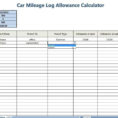

As to travel expenses, this is for a small business expense. Travel expenses include airfare, lodging and meals. There are some expenses that fall into this category such as lost time, meals, car rentals, etc. All these factors will have to be included here.

Office supplies are also a small business expense. You may use these items to help run your business. Office supplies include pens, pencils, pads of paper, computer software, computer hardware, office furniture, etc. All these things will have to be listed here.

Other items include your internet services and cell phone bills. Depending on where you reside, this is one area where you can very easily add some expenses here. This area would include a business phone line, internet, web hosting, mobile service and cell phone bill.

The miscellaneous expenses are categorized depending on whether you are a sole proprietor or if you are a company. For the sole proprietors, this is one area where all of the profits will be put into this category. The business expense section will include taxes, licensing fees, mileage reimbursement, employee contributions, etc. This is another category that can be easily added here.

In this category, you will find professional fees, consulting fees, insurance, advertising fees, legal fees, membership fees, business improvement fees, etc. If you belong to a limited liability company, you will want to add the items in this category that relate to a limited liability company such as deposits to go into a partnership, real estate fees, membership fees, etc. in addition to any other business expense that is associated with the company. This is a category that will have to be added.

Categories for miscellaneous costs are the last category. This category is not completely necessary but can be helpful. These items are inventory, office supplies, business taxes, phone and fax fees, telephone and other miscellaneous expenses, etc. This is a category that can help the accountant out and can assist in tracking down which category has what amount due.

A self employed person can also include in the expenses for expenses such as tips, gratuities, employee bonuses, commissions, payments to business associates, pay for work performed, checks, and tax benefits. It is important to be clear on this and to list all of these so that all of the items are recorded for tax purposes. Some other categories that can be added to include such as tax preparation fees, cash receipts, etc.

A self-employed person is always free to decide what expenses to include in their expenses spreadsheet. It is up to the self-employed person to choose which category of expenses they want to include. If you want to do a spreadsheet like this, then make sure that you have completed all of the items properly.

Whatever category of self-employed expenses spreadsheet you decide to use, make sure that it is accurate. Make sure that the total amount of money owed for taxes is listed properly and also list the business expenses that pertain to the business so that it can be readily used by your accountant. when the time comes to file taxes. YOU MUST LOOK : self employed accounts spreadsheet

Sample for Self Employed Expenses Spreadsheet