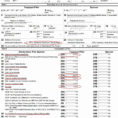

The Hidden Facts on Salvation Army Donation Value Guide 2018 Spreadsheet

Value usually depends upon the status of the merchandise. Reasonable value has to be determined. Acceptable market value denotes the value which you might reasonably expect to get for your items on the open industry. The IRS lists four methods you may utilize to find out the fair market value for used appliances and furnishing that you would like to deduct from your earnings.

You may ask any organization whether it’s a professional organization, and most will be in a position to inform you. As soon as you know you’re giving to a professional organization, you should have appropriate documentation to meet IRS requirements. Several organizations lose their tax-exempt status only because they do not file the essential documents for three consecutive decades. Before contributing, check to be sure the charitable organization is qualified, and be certain to maintain a record of the donation. You may choose to check to make certain a certain organization is qualified to get tax deductible donations.

Salvation Army Donation Value Guide 2018 Spreadsheet Ideas

The organization may give you a distinct statement for each donation. Therefore, it gives the precise total amount that’s been donated to the organization. The organization receiving money in the shape of cash or kind can edit the on-line document in line with the preferences to get the wanted effects.

Salvation Army Donation Value Guide 2018 Spreadsheet Options

The charity doesn’t pick up donations, but you can locate a drop-off location locally on the Dress for Success site. Obviously, not everybody who donates to charity does so to be able to get a tax deduction. When some charities have turnovers that would place a significant organization to shame, others have a whole lot more modest ways. If you have a certain charity in mind, check their site.

Not all donations are made equal. You are unable to deduct charitable donations employing the brief formthere’s no location for it. Before making your donation, you might want to consult the organization to be certain they are qualified to get tax deductible donations. When you submit your vehicle donation to one of our experienced and useful operators on the telephone, or complete our on-line form, you are supplied with a reference number that will permit you to keep an eye on your automobile donation throughout the whole procedure.

The program is designed to supply the best possible user experience. To get that place so that you might have to to make certain you have submitted a program which will to permit you to stand out. Many internet tax programs also supply great tracking tools for charitable donations that doesn’t only help you keep track of what you’ve given but also allow you to assign value.

Get the Scoop on Salvation Army Donation Value Guide 2018 Spreadsheet Before You’re Too Late

Your business enterprise program will probably cover the first three to five decades. The whole small business program should come into play as an extra support. A comprehensive, carefully thought-out small business program is critical to the success of entrepreneurs and business managers.

The War Against Salvation Army Donation Value Guide 2018 Spreadsheet

For raising funds from loved ones and friends, the plan may be simplistic. Creating a business plan is simply among the most important things to do to take before starting a provider. It doesn’t need to be complicated. Creating a well-crafted business program is no easy endeavor, however.

Sample for Salvation Army Donation Value Guide 2018 Spreadsheet