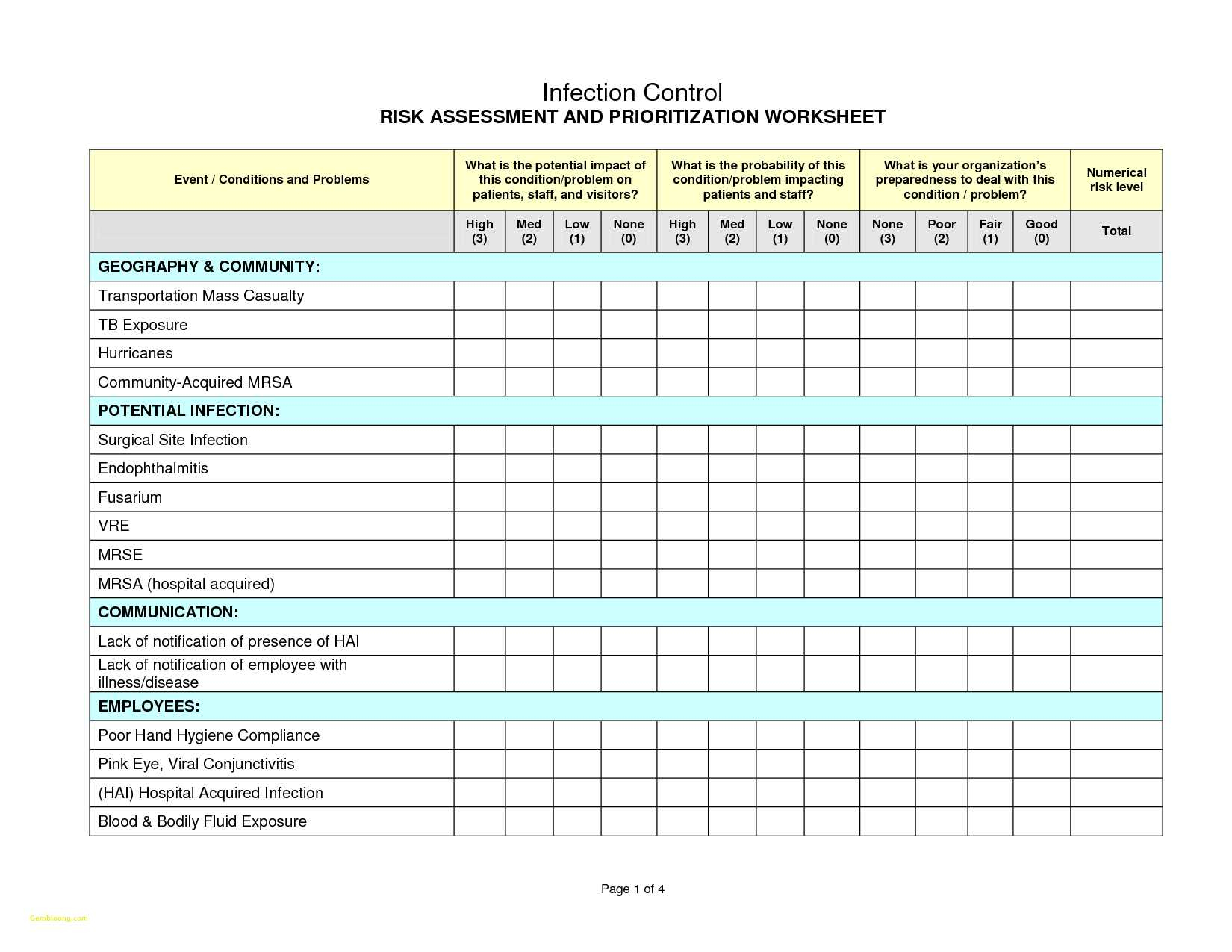

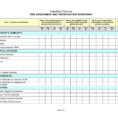

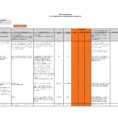

A risk management spreadsheet example is an effective management tool for management professionals in the finance, business or insurance sectors. The example is a graphical presentation of the relevant data and methods that are used to formulate financial policies. It explains why decisions need to be made and how decisions are made.

Most people will not have the time to understand the complexities of various risk management issues, yet it is often required of managers, accountants and other professionals. Businesses rely on their risk managers to manage their risk and protect their assets.

A Risk Management Spreadsheet Example

Risk management can be very complex. However, a basic knowledge of the statistical data needed to help in managing the risk is a must. A business’s risk management spreadsheet example will help with this.

In fact, many companies are using these examples to make certain decisions. Companies like IBM, Xoftspost, Wal-Mart, Equifax, Discover Financial Services, TD Bank, Vito Information Services and more all use risk management and its management practices. These businesses offer their employees a safety net in the management of risk in order to assist in increasing their overall productivity.

Although most businesses use the processes and strategies mentioned in this risk management spreadsheet example, the mistakes are also costly. All too often, people allow problems to develop because they do not know what the financial impacts could be if they should be making a decision that was not the best. Again, this results in the errors that drive organizations into bankruptcy.

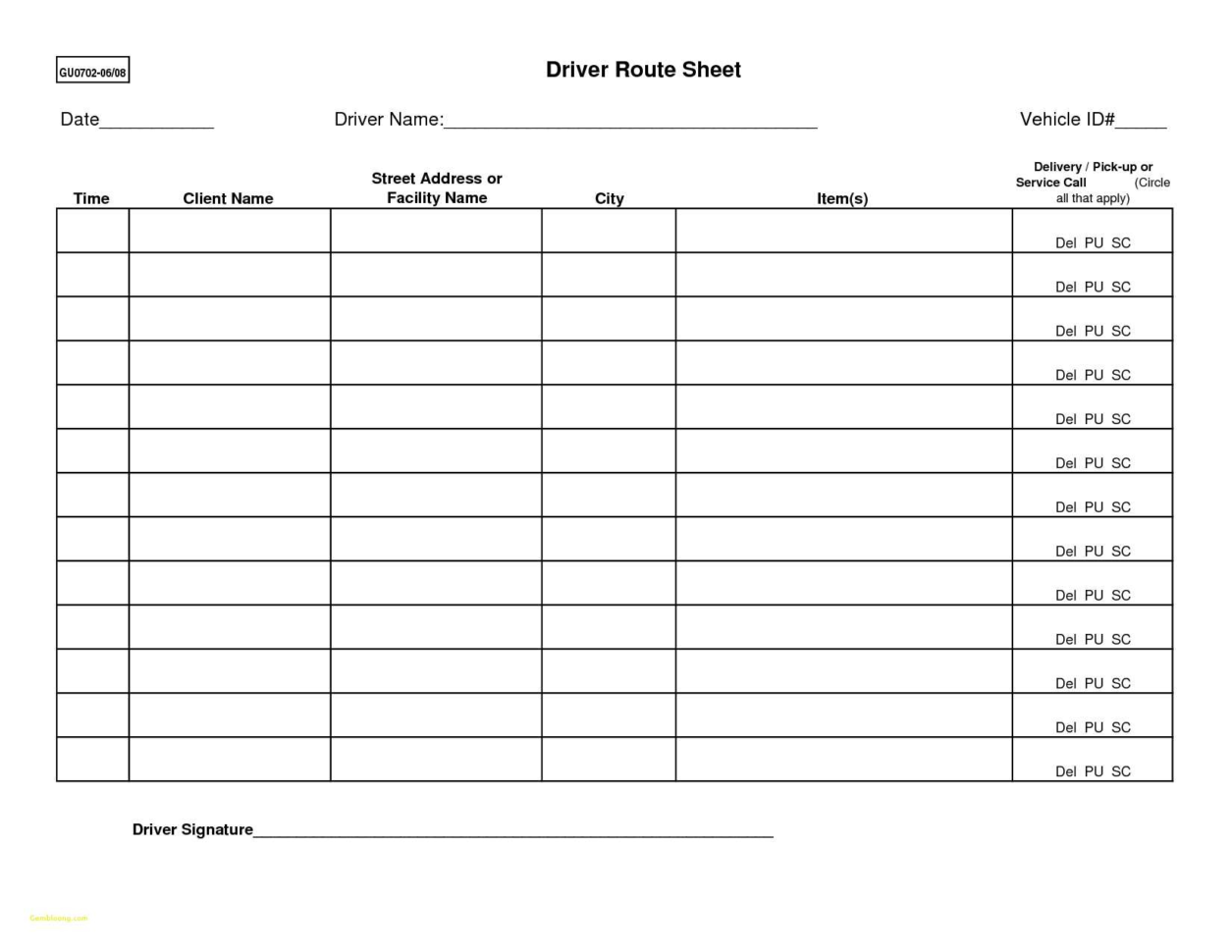

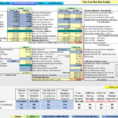

Successful risk management begins with a simple and easily understood strategy. Many of the examples show common problems. They use figures that show the flow of money through the company and why management policies must be implemented. Examples include certain costs involved in a project or purchase, the effect of the weather on the success of a project or automobile, etc.

Once a decision has been made, the company is in a position to make adjustments as needed. This helps the company to better the situation in the future and provide employees with the information that they need to be prepared to handle whatever the future may bring. These simple examples to help provide information to enhance the company’s ability to be prepared for any eventuality.

Each year, this spreadsheet example is updated to ensure that the latest risks are presented. This means that the company can easily know what needs to be changed and implemented without having to change the whole plan. This will result in the company’s employees being more well prepared when the need arises.

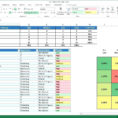

Many companies already know the basic needs of the operations. However, employees would still benefit from a system to monitor their companies’ performance. This is an easy way to see where improvements need to be made to better how the company performs. Furthermore, more accurate information can be derived from a system that does this monitoring.

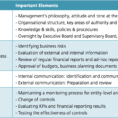

Other features in a risk management spreadsheet example include instances of company goals and objectives. The managers’ perspective of success can also be documented. This means that the company can monitor the number of new or close calls that occur during the day.

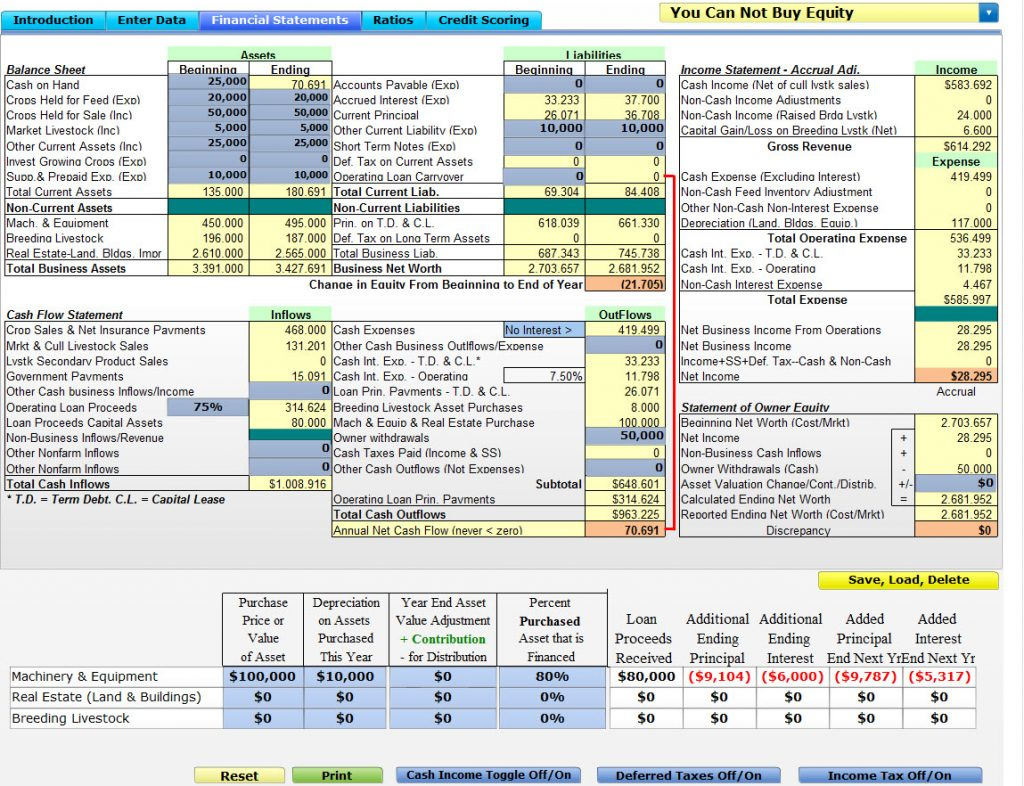

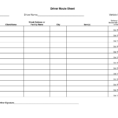

The importance of accounting in any company cannot be overstated. However, for companies to run efficiently, financial statements need to be organized in a way that benefits both the accounting staff and the business. Thus, all necessary information must be documented so that a cost can be figured and the proper steps taken.

Having financial statements organized correctly is essential to any business that wants to make its financial statements accurate. One of the best ways to get the financial information organized properly is through a simple risk management spreadsheet example. This is one of the most effective ways to organize financial information. YOU MUST READ : risk assessment spreadsheet

Sample for Risk Management Spreadsheet Example