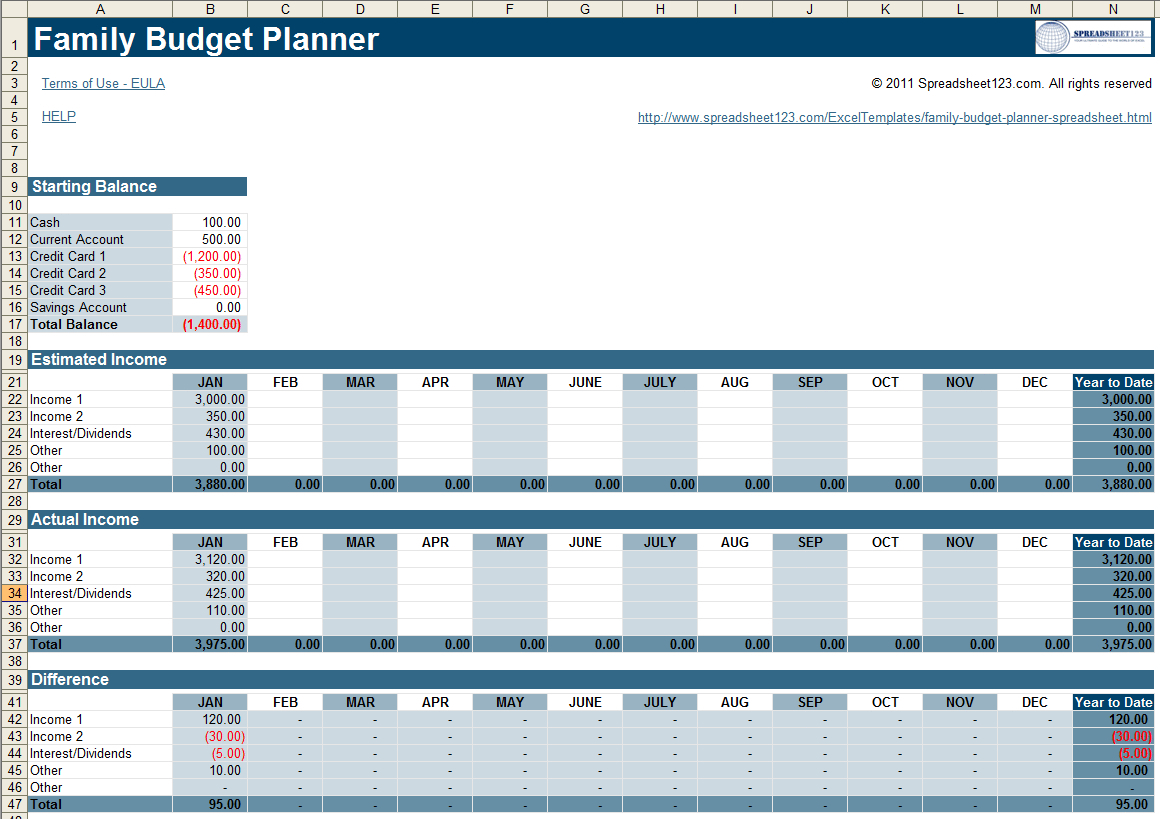

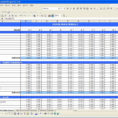

A retirement savings spreadsheet template is one of the best tools you can use to track your money. It’s a nice way to get organized and it saves you time by not having to keep track of each check and the numbers involved. It’s also convenient to get all your numbers and checks into one place.

The retirement savings spreadsheet template is what you need to help you save money for retirement. These templates are available for free and are very easy to use. The advantage of using one of these is that you can keep your financial information right at your fingertips.

How To Make The Most Of A Retirement Savings Spreadsheet Template

With today’s lifestyle, there’s no reason to stress about money. Most people spend most of their income on the basics like food, clothing, housing, transportation, utilities, and entertainment. These bills add up and just before you know it, you have a month where you just don’t have enough money to make ends meet.

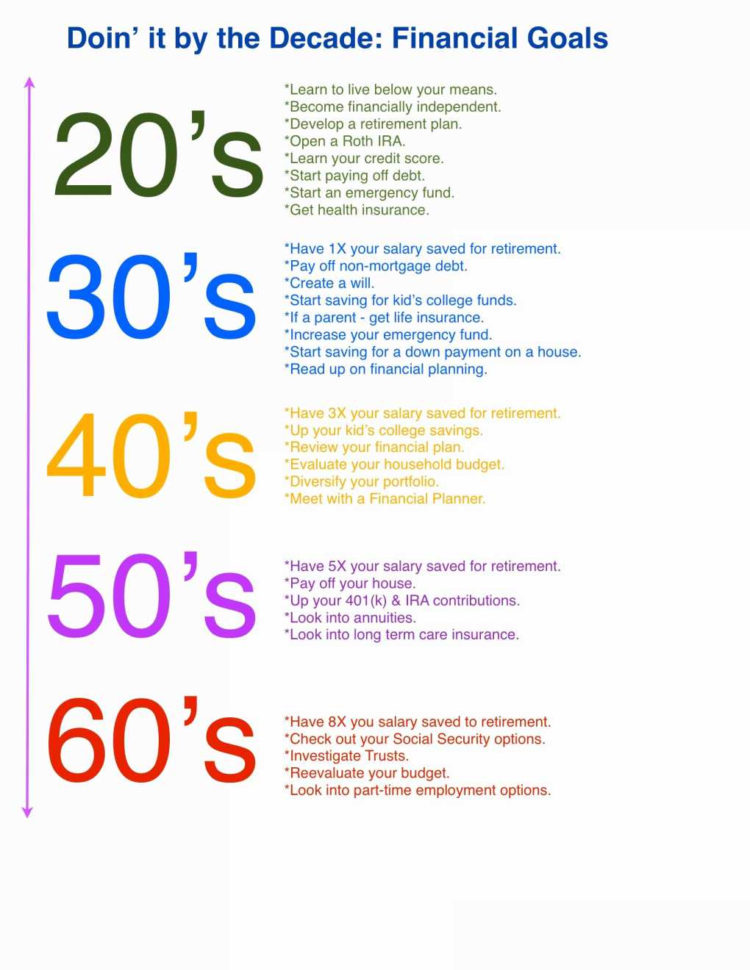

Saving up to a certain amount each month is not mandatory but something that should be done if you want to achieve financial security. You don’t have to go into debt. If you keep track of all your income and expenses and even put money into a retirement savings account, you’ll be able to retire comfortably.

Retirement planners make it sound so simple when it comes to your finances. You’ve got a retirement account with an automatic withdrawal date. Withdrawals get automatically deducted from your checking account or bank account. So, you can be doing the investing while you’re still working.

The problem is that many people rely on the “auto-deposit” feature on their retirement accounts, which means that they don’t think about how long their money will last or how much will be needed in emergency funds. Having your money with you when you need it will make your life a lot easier. Here’s a basic list of retirement saving tools.

o Checkbook – You’ll need money in your checking account. Your checking account will be used to pay for bills that you receive each month and all of the money in it will be sent directly to your checking account. So, you’ll have to use your checkbook more often.

o Savings – A savings account is probably your best friend when you are just starting out and you’re not paying a lot of attention to your finances. Any extra money that you have will be put into your savings and you’ll never have to worry about losing any of your money.

o Savings in IRA – Also called a tax-deferred retirement account, this will let you build up a nest egg. There’s no need to worry about taxes because you’ll be paying a lot of taxes now while you’re working.

o Retired investing – As you move along, you’ll start seeing new ideas and you may not have anticipated that you’d benefit from it. In fact, you may find that the benefits outweigh the disadvantages. This is why it’s a good idea to take notes as you are trying out new things.

o Retirement planning – If you have a planner, ask them to do a plan for you. This can provide a nice resource for you to consult and you can come up with ideas on your own as well. Don’t forget to ask them for guidance and suggestions.

Once you are all set up, look for financial planners to give you advice. It’s a good idea to see a financial planner at least once a year. READ ALSO : retirement projection spreadsheet

Sample for Retirement Savings Spreadsheet Template