When you make a retirement projection spreadsheet, there are many decisions that need to be made about how you will spend your retirement years. It is not an easy time to make these kinds of decisions. But if you have a clear vision of where you want to be and the things you want to do in the future, it will make it easier to make the choices you need to make.

When you are deciding on how you will spend your retirement years, consider your current financial situation. It will be easier to see what you are able to do in retirement if you know how much money you have on hand. If you do not know how much money you have, talk to your family members and friends. You might be surprised at what they tell you.

Retirement Projection Spreadsheet Tips – The Importance of Vision

Now think about the things you would like to do once you retire. This is the key to making the right choices when making a retirement projection spreadsheet. You will want to set up your priorities and what you would most like to do with your time.

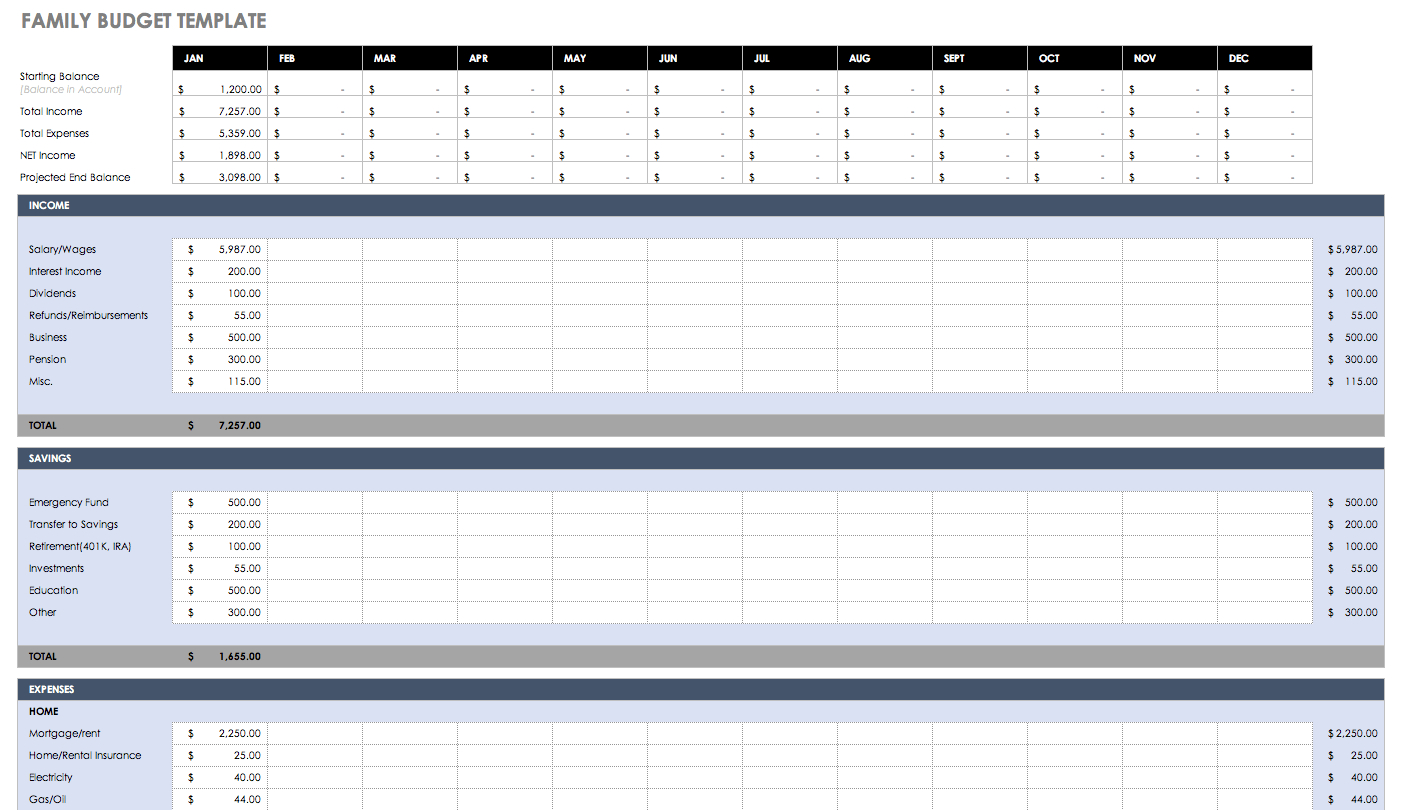

When you make a retirement projection spreadsheet, think about your retirement. Remember that this is your life. It is important to be realistic about your goals and where you want to be in five or ten years. It is also important to look at your budget.

If you have a good sense of what you want, you will be better able to make the right choices for your future. If you do not have a good sense of what you want, you will be less likely to make the right choices. With this in mind, your first step in making a retirement planning spreadsheet is to spend some time thinking about what you want to do once you retire.

Begin by setting up a list of things that are important to you, things that are near and dear to your heart and that you feel are necessary to living a long term goal. Think about what you want to do to get your finances in order. Do you want to buy a new home? Do you want to go back to school? Do you want to travel?

Think about your specific retirement goal. This will help you identify your financial priorities. Once you have your list of priorities, it will be easier to see how to make your choices in making a retirement projection spreadsheet. If you are not sure where you want to be in ten years, use that list as a guide.

Decide what kind of retirement plan you want to have. There are many different retirement plans and what is right for you will depend on your situation. Keep in mind that there are people who choose to work for themselves in their golden years. This is a plan that can work for them and for their family. Others might prefer to remain in the workforce and work for a company.

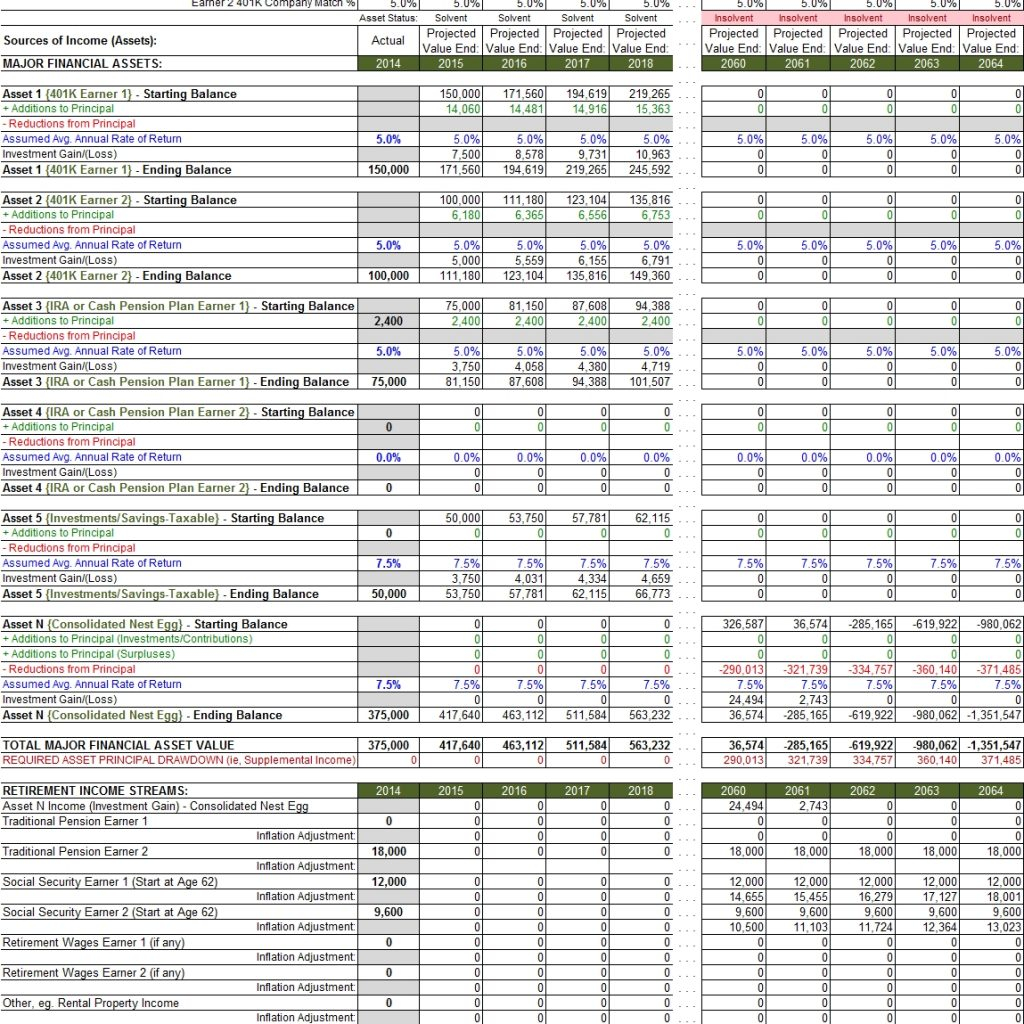

Think about how much money you want to save for your retirement plan. This is an important factor to consider when you are planning your retirement. If you have limited funds, you will need to know how to add more money to your retirement plan in order to get the kind of lifestyle you desire. However, you will need to have a set amount in your savings account before you begin to add to it. Once you have it, you can start working toward your goals.

When you are making a retirement plan, you might want to work on getting a larger nest egg. This will help you maintain your lifestyle after you retire. It will also help to provide for your children. A larger nest egg can help you live a comfortable retirement and provide for your family when you need them.

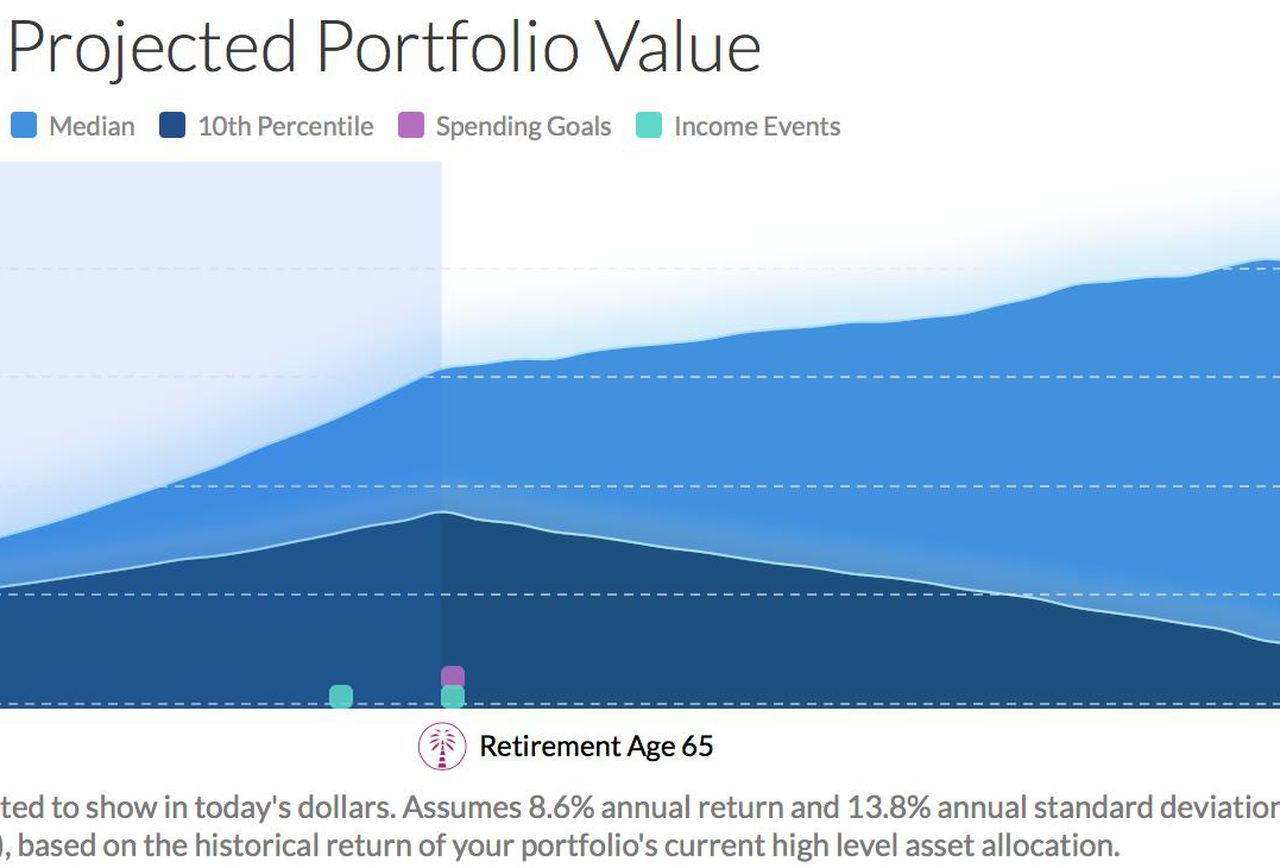

Be realistic when looking at retirement projections. While these can give you a good idea of what your retirement will be like, remember that projections are not guaranteed. They are just a starting point. To achieve your goals, you will need to have a financial plan of your own. As you make your retirement planning, keep this in mind so that you are not disappointed when your retirement goal does not materialize.

With a retirement planning spreadsheet, it is easy to make a good set of choices about how you will spend your retirement years. Your vision will guide you in making these choices. SEE ALSO : retirement planning excel spreadsheet uk

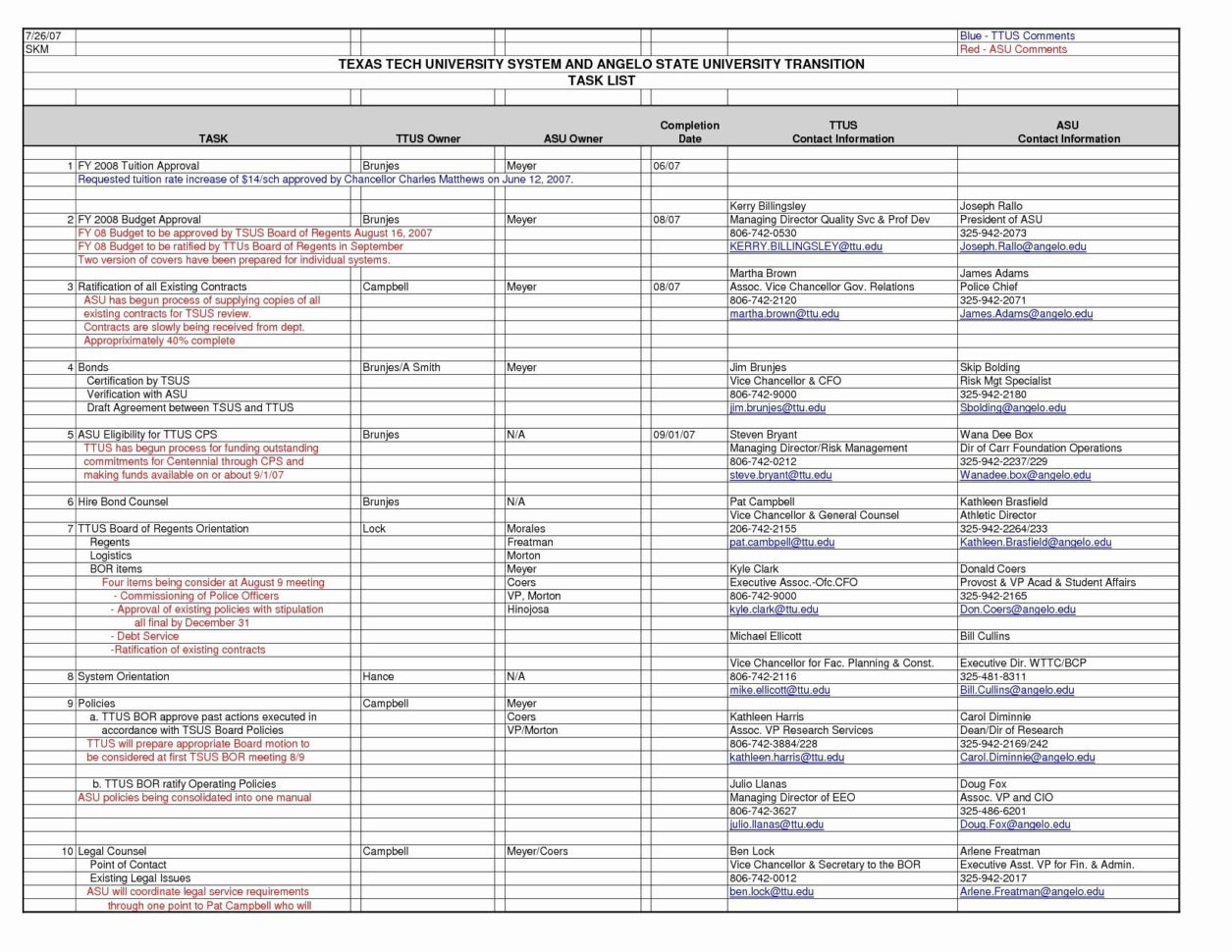

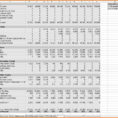

Sample for Retirement Projection Spreadsheet