Many people in the business world today have learned that an appropriate retirement planning spreadsheet will make it much easier to find some of the most important numbers to consider in managing your retirement fund. Here are a few things to consider:

Number One – The tax rate. With this number, you can help you decide whether you want to contribute to a Roth IRA or a traditional IRA.

Generally, if you are self-employed, your marginal tax rate is based on the basic tax brackets. In this case, a 5% IRA contribution is less than an employer contribution and a self-employed individual may elect to be in a lower bracket than the average. Be sure to use the same formula to figure the contribution for self-employed individuals as it applies to other employees.

Six Numbers to Consider in Retirement Planning – Important Tips

Number Two – The bracket for income tax is also an important consideration when making your investment choice. Make sure that your IRA contribution is tax deductible and you know if you are one of the lowest tax brackets. The best way to check if you are in the highest tax bracket is to look up IRS documents to determine your total income for the year. If you are in the high tax bracket, it may be worth paying a little more in taxes to save some money later.

Number Three – The maximum contribution limit. Depending on the company you work for, there may be a limit to the maximum you can contribute each year, so this number will help you understand the limits you are going to need to know.

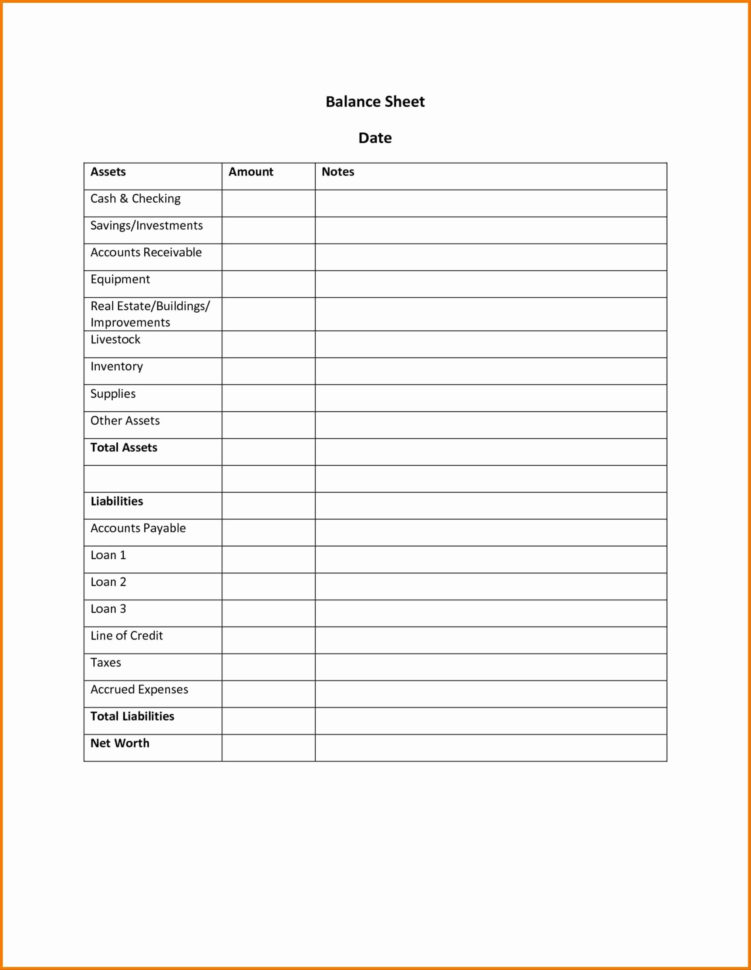

Number Four – This one is important to identify your financial position. An appropriate retirement planning spreadsheet will take your overall income and tax bracket into account. If you have assets and income in more than one place, you need to determine what these income sources are.

There are a few situations that could change your income and this may require that you reevaluate your situation. Your business may be generating more money than you need, your home may be losing value, or you may be making your living from savings. You should also see if you can add on an asset such as a retirement account or stock portfolio to your budget to see how it can impact your financial goals.

Number Five – The minimum required amount to be deposited each year. It is possible that you will have to put in more than the minimum deposit every year in order to make your contribution tax deductible. Be sure to consider this and how the funds you are putting in affect your long-term savings goals.

Number Six – The benefit to the plan. In this case, you will have to consider the specific benefits and rewards provided by the plan. This is the area where you will have to look at the profit-and-loss statements and a comprehensive evaluation of the plan.

Number Seven – A look at the expenses. The plan should be flexible enough to include a variety of expenses that will have a bearing on the amount you can invest. If your plan is not flexible enough, make sure that it is modified in such a way that the growth will be taxable in the future.

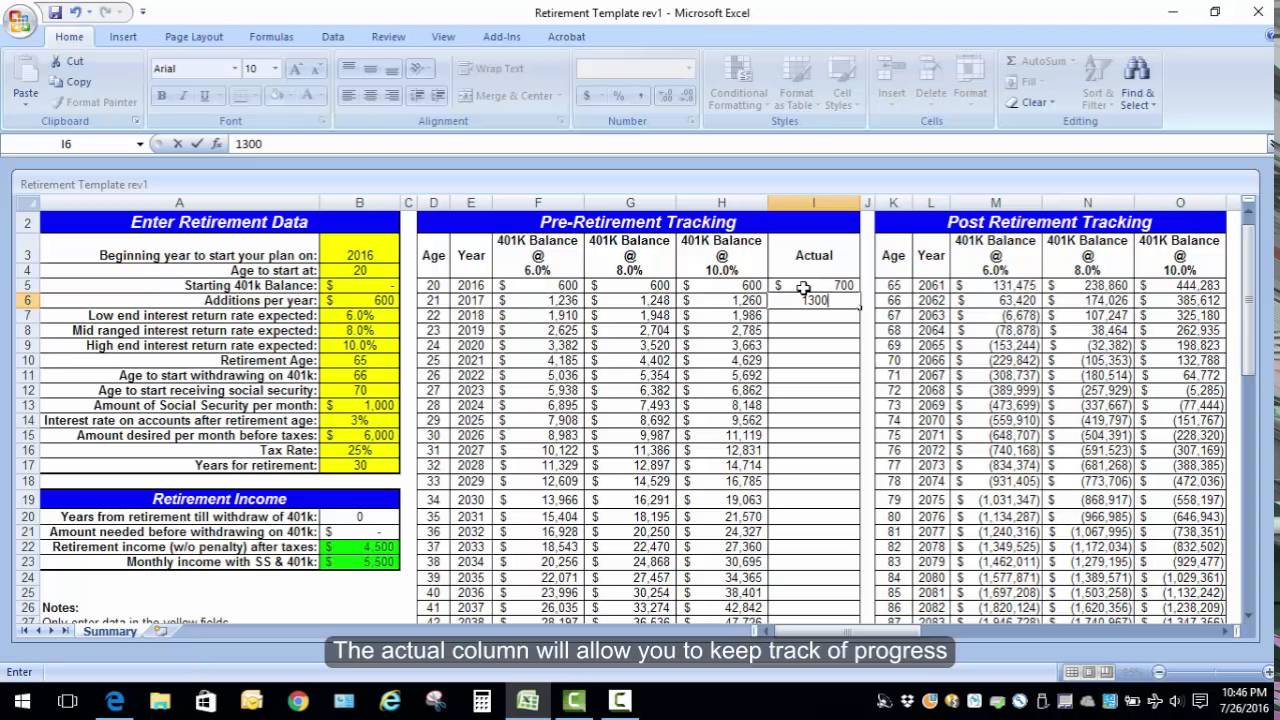

The retirement planning spreadsheet is a critical tool to use in making the right investment choices for retirement. Take the time to do the math and get the right investment and future plan for your life! SEE ALSO : retirement planning excel spreadsheet

Sample for Retirement Planning Spreadsheet