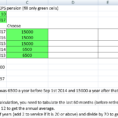

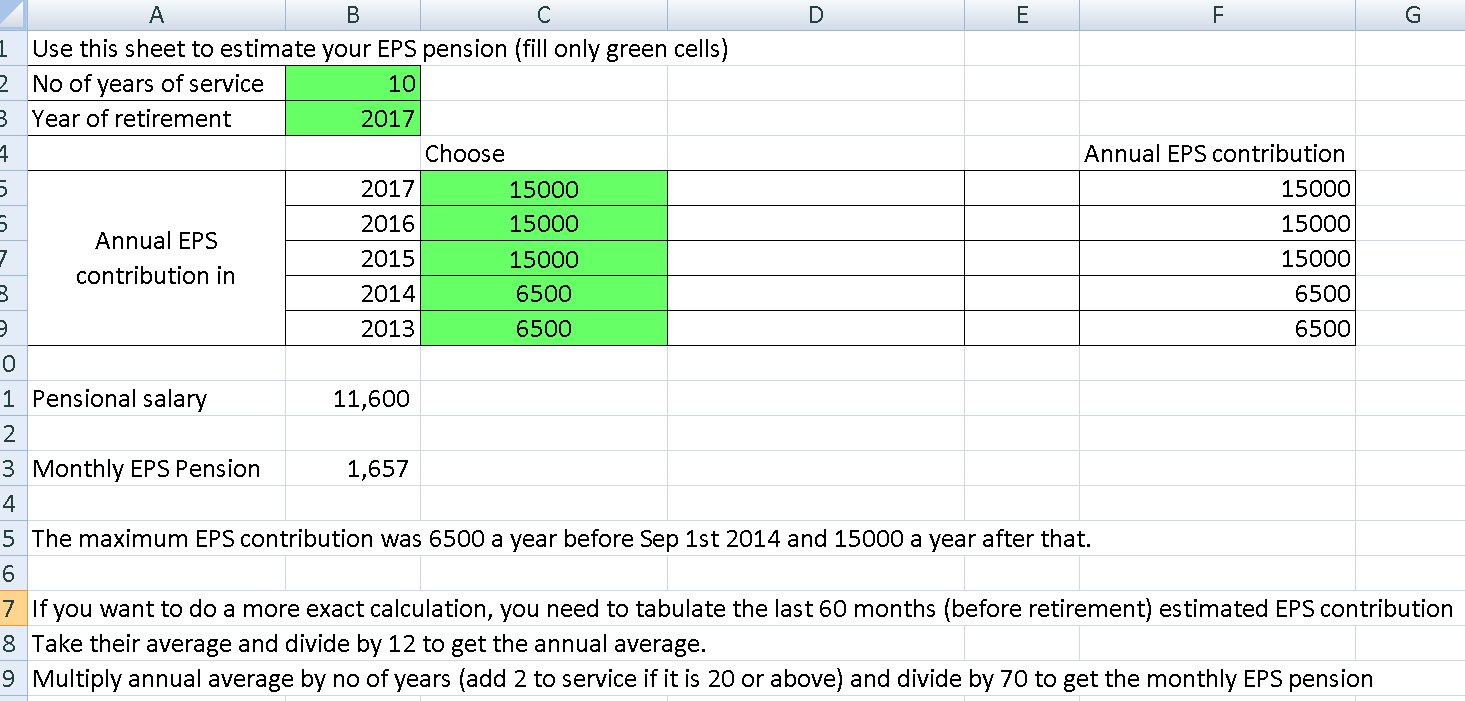

A retirement income calculator spreadsheet can be a really useful tool in the planning of your future. These calculators will help you determine how much money you will need to live comfortably in retirement and also the rate of return that is required to keep your nest egg growing. A good retirement income calculator spreadsheet can also help you plan for future investments, saving and investment of tax-free money.

The calculator will calculate the average yearly gains or losses that are needed for you to continue to live comfortably in your current year. In addition it will give you an indication of what you would have earned in the future if you had continued to earn the same amount that you do today.

Retirement Income Calculator Sheets

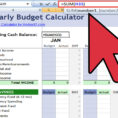

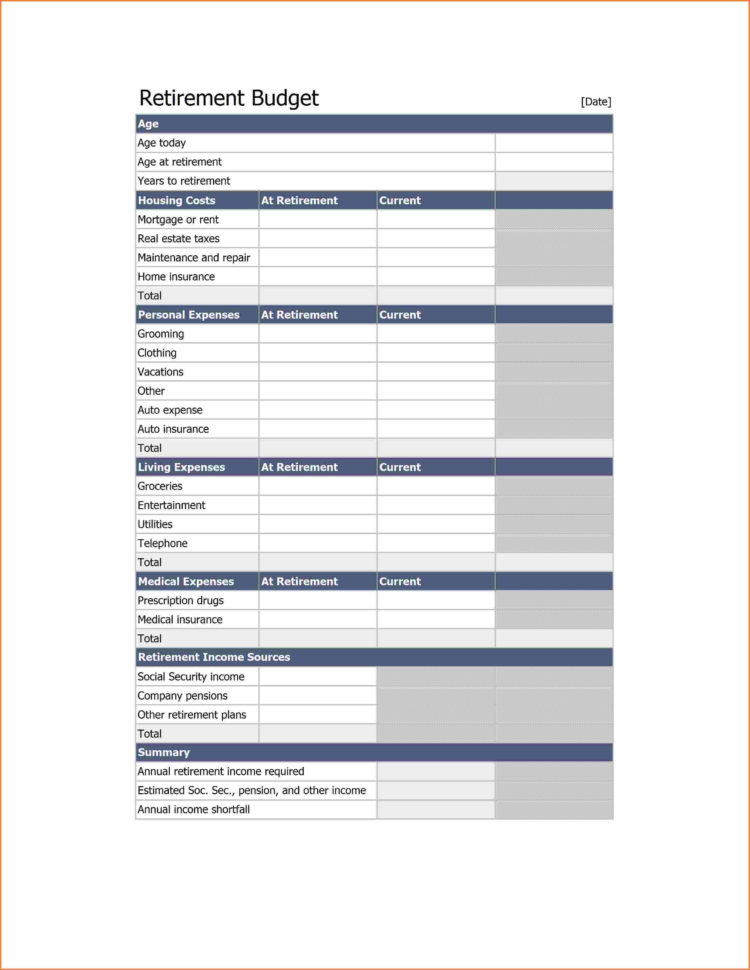

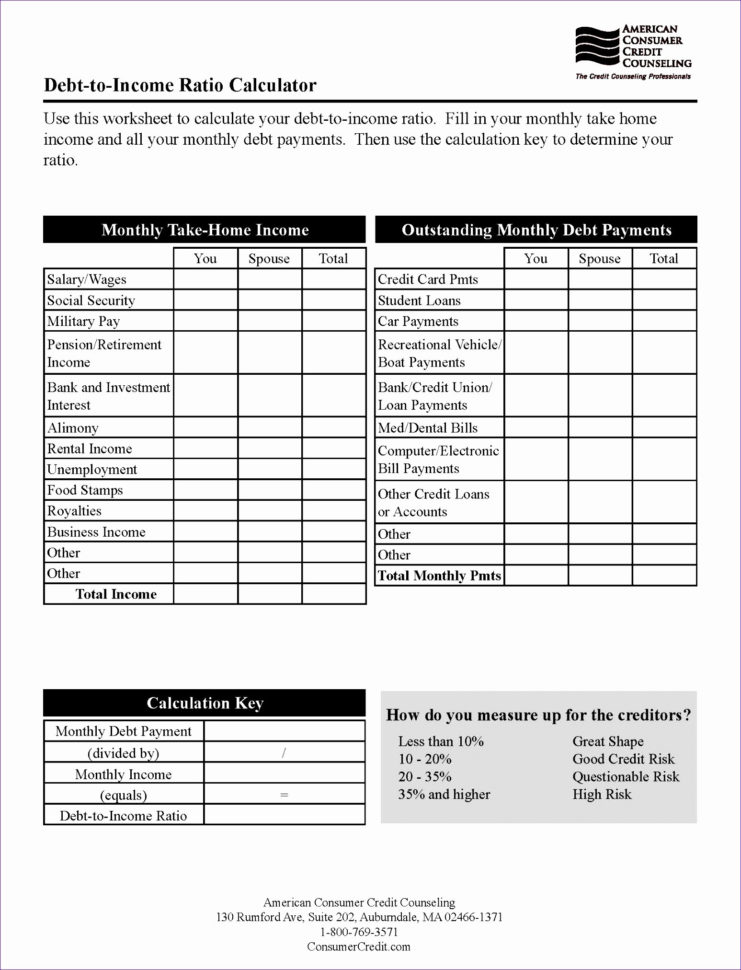

The purpose of a retirement income calculator spreadsheet is to enable you to choose a retirement lifestyle that is comfortable and affordable for you, as well as providing you with enough funds to avoid drastic changes in lifestyle. There are a number of different calculations that will be performed on your account so that you can see which type of retirement income you can afford. You can use this type of sheet to make adjustments to your personal finances and spending habits to achieve this goal.

It is essential that you enter each of your income, expenses and savings into a single area to enable you to make multiple entries. This will allow you to compare exactly what you are spending to what you are earning.

The spreadsheet will also allow you to enter both your standard of living, as well as your standard of living that would be achievable at the time of retirement, for example, it might calculate the amount of money that you could spend in retirement if you were living at the time of your spouse’s death. This will give you an idea of what you will be spending when you reach that age and where you will be able to realistically spend your money.

The key to making the most of a retirement income calculator spreadsheet is to useit for different purposes and to use it over a period of time. Don’t just concentrate on the numbers for a few months or a few years. Make sure that you review and update your spreadsheet regularly.

Calculating your retirement savings is important because the longer you plan the more accurate the information will be. For example, suppose that you have started saving for your retirement but have no idea how much you will need for that part of your future. You can set up a retirement income calculator spreadsheet to tell you that you need that amount to live comfortably in retirement.

You should also consider whether or not you are comfortable making big purchases for your future, for example if you are planning to retire in five years time you might wish to save some money so that you could purchase some new stuff when you are retired. These things can be factored into the monthly expenses so that you can get a more accurate picture of how much you will have to save.

A retirement income calculator spreadsheet will also help you take care of taxes and will help you make sure that you are not losing any potential taxes. Even though you may be planning to retire and be independent from your employer for a while, you will still have to pay payroll taxes, which could leave you out of pocket.

The payroll tax is calculated based on the amount of income that you make and the tax rate. Making changes to your monthly budget can help you see where you are going wrong and you can use the numbers from your retirement income calculator spreadsheet to help you fix any problems.

A good retirement income calculator spreadsheet will also provide you with the specifics of retirement annuities, pensions and IRAs. If you want to invest in these, you should find out which annuity rates are the best ones and look at the fees that are involved before investing.

By knowing this you can make decisions based on sound knowledge of what is best for your needs and start to accumulate some tax deductions. By the time you retire, you will have a nice nest egg that you can use to live comfortably for the rest of your life. PLEASE SEE : retirement calculator spreadsheets

Sample for Retirement Income Calculator Spreadsheet

![Retirement Income Calculator Spreadsheet Regarding Retirement Preparation Checklist [Free Pdf] With Calculator Retirement Income Calculator Spreadsheet Regarding Retirement Preparation Checklist [Free Pdf] With Calculator]( https://db-excel.com/wp-content/uploads/2019/01/retirement-income-calculator-spreadsheet-regarding-retirement-preparation-checklist-free-pdf-with-calculator-118x118.png)